Generally Accepted Accounting Principles (GAAP)

Hello again,

This post is for small to mid-sized companies who may be vetting a new accounting system. We hope you find it useful.

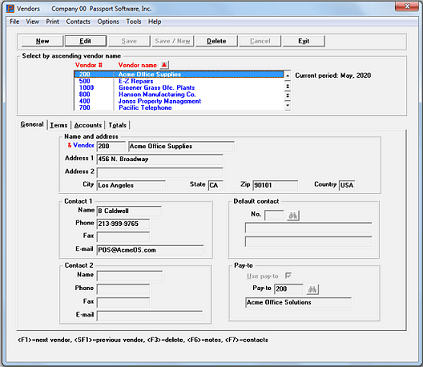

Accounting software for small business and mid-sized companies can help protect an owner by guiding the entry and processing of data according to certain Generally Accepted Accounting Practices (GAAP standards).

The following is sourced from Accounting.com:

“Generally accepted accounting principles, or GAAP, are a set of rules that encompass the details, complexities, and legalities of business and corporate accounting.

The Financial Accounting Standards Board (FASB) uses GAAP as the foundation for its comprehensive set of approved accounting methods and practices.

U.S. law requires businesses that release financial statements to the public and companies that are publicly traded on stock exchanges and indices to follow GAAP guidelines, which incorporate 10 key concepts:

· Principle of regularity: GAAP-compliant accountants strictly adhere to established rules and regulations.

· Principle of consistency: Consistent standards are applied throughout the financial reporting process.

· Principle of sincerity: GAAP-compliant accountants are committed to accuracy and impartiality.

· Principle of permanence of methods: Consistent procedures are used in the preparation of all financial reports.

· Principle of non-compensation: All aspects of an organization’s performance, whether positive or negative, are fully reported with no prospect of debt compensation.

· Principle of prudence: Speculation does not influence the reporting of financial data.

· Principle of continuity: Asset valuations assume the organization’s operations will continue.

· Principle of periodicity: Reporting of revenues is divided by standard accounting time periods, such as fiscal quarters or fiscal years.

· Principle of materiality: Financial reports fully disclose the organization’s monetary situation.

· Principle of utmost good faith: All involved parties are assumed to be acting honestly.

GAAP compliance makes the financial reporting process transparent and standardizes assumptions, terminology, definitions, and methods.

External parties can easily compare financial statements issued by GAAP-compliant entities and safely assume consistency, which allows for quick and accurate cross-company comparisons.”

Professional level small business accounting software can help companies simplify their business processes, adhere to GAAP standards, and comply with changing tax jurisdictions and regulations.