Payroll Software for the Small to Medium Sized Company

Hello again,

This post is for small to mid-sized companies who may be vetting an in-house payroll system.

Everyone loves a pay check but not many love payroll preparation, especially in a smaller company.

Often, staff and management work in multiple areas, so payroll preparation is done in addition to other duties. Distractions and interruptions can reduce the ability to manage details so errors result.

Small business payroll software offers a level of security and protection for these circumstances.

Payroll Service Providers

Many payroll service providers rely on owners’ or managers’ reluctance to undertake payroll preparation, creating an atmosphere of complexity and penalty hazard.

The business model of a payroll service provider is usually recurring revenue. Considering that much of the preparation for a payroll service gets done by the employer, the cost is really for the reduction in liability, not so much the actual work.

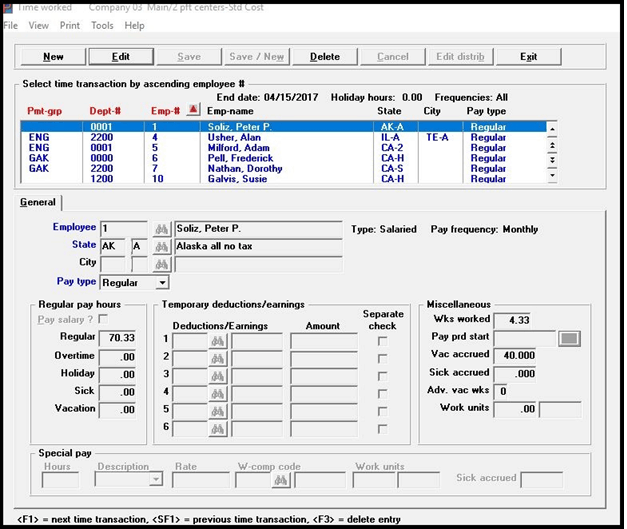

With top-rated small business payroll software, the work and risk of preparing and successfully distributing payroll is greatly reduced and so is the cost.

Control Over Your Data

First, the software has controls to safe guard sensitive employee data from unauthorized eyes. Sometimes payroll is an open topic, but if it isn’t, unintended exposure can be uncomfortable, creating ill-will and moral problems.

In the best small business payroll software, the ability to email passworded payroll stubs to employees is included. For businesses with multiple locations or separate buildings this can be a substantial time-saver.

Direct Deposit

Most employees consider direct deposit to be helpful. No need to stop at the bank to deposit a check helps save gas and one less errand helps too. Having a second bank account into which a % of a paycheck is deposited encourages saving money without too much effort.

Automatically sending funds to discharge obligations can help simplify life. Comprehensive small business payroll software includes this option.

Federally mandated reporting changes are issued almost every year and high quality small business payroll software is updated annually to help make compliance easier.

With 35 years of payroll processing experience, Passport Software provides comprehensive yet easy to use in-house payroll software for small businesses and medium sized companies.

The payroll module is part of Passport Software’s accounting software solution.

Call 800-969-7900 – Or Contact Us. We are here to help.