Proper Tracking With Accounts Payable Software for Small Business

Keeping Accurate Records: Updated Form 1099-MISC and New Form 1099-NEC

Hello again,

This post can serve to help companies with proper tracking of their accounting records. It was written by Jim T., Passport Software’s Director of Training. We hope you find it useful.

Accounts payable are amounts due to vendors or suppliers, for goods or services received, that have not yet been paid for. The sum of all of these bills, at a given point in time, will appear on a company’s balance sheet as a liability.

The Accounts Payable General Ledger account represents the unpaid vendor bills at a point in time. If your business is ever subject to an audit, whether from the Internal Revenue Service, or a Certified Public Accountant, it is crucial to have accurate records that can be produced on demand.

The proper tracking of Accounts Payable is one of the foundations of a business’s accounting records. Vendor bills need to be recorded in the correct period, matching the expense with the related revenue. The vendor needs to be paid on time, to maintain a healthy supply relationship, and the expense needs to be recorded to the correct General Ledger account.

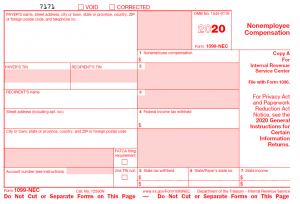

Form 1099-NEC

One aspect of accounts payable warrants some extra attention, as we begin the final quarter of calendar year 2020. We will be required to send 1099s to many of our vendors. Most of the rules are familiar and unchanged.

For example, the $600 threshold for reporting nonemployee compensation is still in force, but Form 1099-MISC has been updated in a very significant way. 2019’s Box 7, Nonemployee compensation, has been moved to its own, new form- 1099-NEC.

This move fixes a flaw in the old Form 1099-MISC, where the Box 7 income reporting deadline was earlier than all of the other types of income. For 2020, Form 1099-NEC is due on February 1, 2021, while Form 1099-MISC is due on March 1, 2021, if you file on paper, or March 31, 2021, if you file electronically.

Nonemployee compensation will now be reported in Box 1 of the 1099-NEC:

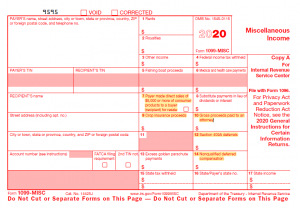

Other Changes to Form 1099-MISC

Form 1099-MISC has several other changes, in addition to the removal of Nonemployee compensation. Box 7, which formerly reported Nonemployee compensation, is now occupied by “Payer made direct sales of $5,000 or more to a buyer (recipient) for resale”.

Box 9 is now filled by “Crop Insurance proceeds” Box 10 is now “Gross proceeds paid to an attorney” Box 11 is blank, as it was in 2019.

In Box 12 it gets a little interesting and complicated, but irrelevant for the vast majority of filers. This is where Section 409A deferrals may go, but per the IRS instructions “You do not have to complete this box”.

If you aren’t paying any deferred compensation to contractors, and most people never will, you won’t need this box, but if you are, please read the details at the end of this post.

Box 13 is unchanged from 2019.

Box 14, which was “Gross proceeds paid to an attorney”, in 2019, is now used for “Nonqualified deferred compensation”. This is related to Box 12, in that it is also regarding deferred compensation.

The instructions for Box 14 are as follows: “Box 14. Shows income as a nonemployee under an NQDC plan that does not meet the requirements of section 409A. This amount is also included in box 1, Form 1099-NEC as nonemployee compensation. Any amount included in box 12 that is currently taxable is also included in this box. This income is also subject to a substantial additional tax to be reported on Form 1040, 1040-SR, or 1040-NR.” See the Instructions for Forms 1040 and 1040-SR, or the Instructions for Form 1040-NR.

The deferred compensation warrants some further discussion, so if this applies to your company, please skip to the end for details.

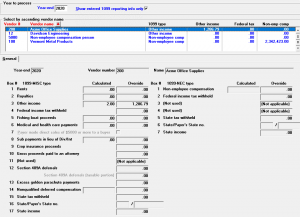

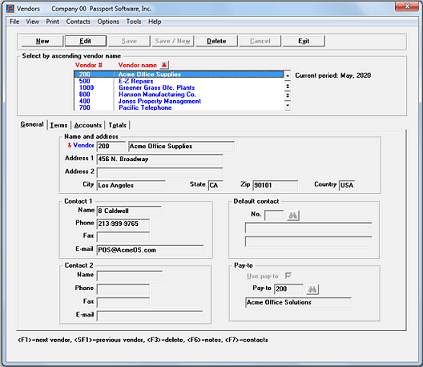

Entering 1099-MISC Data using Year-end (1099-MISC reporting info)

Data for 1099 reporting is normally generated throughout the year when posting in Payables (Post), Print checks and post and Open items (Post). If for any reason you have to change an amount or add a 1099 vendor with a 1099 amount you may do so on this screen.

The 1099-MISC reporting info screen has been updated for 1099-NEC reporting. The left side of the screen has the 1099-MISC amounts where the right side of the screen now has the 1099-NEC reporting amounts. Here is the updated graphical screen:

Using character mode there are now two screens. The first has the 1099-MISC amounts and the second the 1099-NEC amounts:

Once editing is done you may now print reports and forms.

This will bring up a report for you to view of all the 1099 vendors and the types of 1099s that will be created for them. Please review this carefully for any inaccurate amounts. For example, if you pay a vendor $1,000 a month, but the report shows a total of $12,020, because you paid an extra $20 for an expense reimbursement, you can correct it on the next screen.

If you go to “1099-MISC reporting info”, you can see the amounts that will print in the various boxes, in the “Calculated” column. If any of these need to be changed, you can simply type in the correct amount.

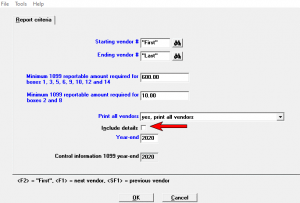

Printing Form 1099-MISC and Form 1099-NEC

The printing of 1099 forms has been updated to allow printing the Form 1099-MISC amounts and Forms 1099-NEC amounts on separate forms. On the screen below, there are check boxes for printing the 5 1099-MISC forms and 5 1099-NEC forms. There is a separate check box for the Form 1096 as well.

Section 409A

Now that we are finally at the end, if deferred compensation is relevant to you, or you are just a glutton for punishment, here’s some information on Section 409A deferred compensation. First some history: Section 409A of the Internal Revenue Code was established in response to the abuses by, most notably Enron, but also many other companies.

Prior to and after its bankruptcy, Enron executives were granted large options to purchase the company’s stock under their deferred compensation plan. The execs then accelerated payments to themselves under their deferred compensation plans, to ensure that they would be able to access to the money and get paid out before the company went bankrupt.

What was supposed to happen, of course, was that the government gets paid first. Standard practice for any bankruptcy proceeding has a well-defined order of payout that is the same: Employees first, taxes next, everyone else after.

Enron execs managed to jump the line via their deferred compensation in stock options. When Enron officially filed for bankruptcy on December 2nd, 2001, it became clear that the loopholes had been seriously exploited. And so, the exploits had to be regulated.

With limited enforcement of principles like the constructive receipt tax doctrine, meaning you pay your taxes when you receive control of the funds, there had been years of companies taking advantage of loopholes in the tax law.

And so, in the summer of 2004, the US government passed the American Jobs Creation Act to, amongst other things, patch those loopholes. It included creating Section 409A deals with this in a few ways, but one of them is by creating a very strict valuation definition when it comes to shares and options.

Before this was passed, companies would value their options using an arbitrary value of something like “10% of the Preferred Stock price”. Now, you have to follow the current tax provisions if you want to remain in compliance and not face penalties.

And the penalties for non-compliance can be severe. All compensation deferred for the taxable year and all preceding taxable years can become includible in gross income for the taxable year. You can then be forced to pay accrued interest on the taxable amount, as well as an additional penalty of 20% of the deferred compensation.

That’s the bad news.

409A – Good News

The good news is that 409A does not apply to incentive stock options (ISOs) and non-qualified stock options (NSOs) granted at Fair Market Value. However, if a company issues options at a valuation BELOW fair market value, section 409A — and all of the aforementioned penalties — will apply.

Consequently, the risk to the recipients (most often employees and advisors) is receiving stock options with a strike price below that of the stock’s fair market value. If you give your employees the option to buy something that is worth $1.00 per share, the only way to avoid a penalty is to make sure you’re giving them the option to buy the shares at $1.00 per share – and not a penny cheaper.

Their opportunity to profit from the options is by helping to grow the company and, in turn, make the stock’s value increase. The reality of the situation is that a company, operating in good faith, with the intent of rewarding employees for helping grow the value of the company, faces little risk of running afoul of the law. If your valuation methods are reasonable and well documented, you have nothing to fear.

Most of you will never have to deal with this, but if you do have a deferred compensation plan, we would strongly advise that you have tax and/or legal professionals prepare your plan documents, and help with determining reporting requirements.

To learn more about PBS™ Accounting or our Accounts Payable Software for Small Business call 800-969-7900. Or contact us – we are here to help.