2020 W-4 Update

Hello again,

This post is for our current Payroll software customers and is sourced from a webinar presented by Peter Dalziel about PBS Payroll Update features.

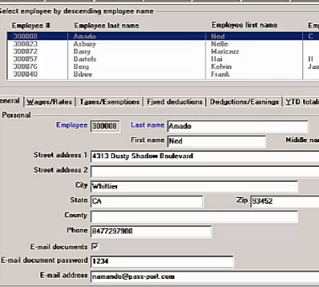

The following post outlines the changes to the Employee (Enter) program to help you enter W-4 information.

We hope you find it useful.

Payroll Update

Today we’ll cover the payroll update and its relation to the 2020 W-4.

Versions covered by the 2020 W-4 update are PBS 12.04.10, 12.05.06, and the current release of 12.06.05. (The 12.06.05 update will cover updated data entry screens and hot fixes from 12.06.04 forward.)

With the introduction of the 2020 W-4 we segregated employees into three categories in PBS Payroll:

Employees hired before 2020 (basically nothing has to be done with these employees except standard maintenance).

The other two categories are both based on new 2020 W-4.

- This includes employees that have filled in a 2020 W-4 based on a change (such as having a child).

- And new employees.

PBS Payroll software allows you to efficiently update an old W-4 employee into a new W-4 employee.

Categories

The first of the two categories in the new W-4 include folks with a single job and one employer, and this reporting process is straightforward and similar to the way it used to be.

The second category is comprised of people who have checked off box 2C. It’s easiest to call them “multi-job” people. This category is comprised of people that have multiple jobs, or a married couple, each having jobs independently of one another.

Our work for today is primarily talking about those employees with the 2020 W-4 – those with single jobs or multiple jobs.

One of the ancillary changes that supports these other changes is that in the marital status table there is a new head of household status; this only applies to employees using the 2020 table, it doesn’t apply to old W-4 employees.

Instructions

Basically, the exemptions are multiplied by a standard rate ($4300 this year) and that total becomes an adjustment to the gross wages. The terminology has changed, but there’s an allowance to bring your wages down to a taxable level, which is now called annual adjustment to wages.

In the Payroll W-4 update, the annual wage adjustment and the FWT adjustment are combined into one field.

To convert an employee to the new 2020 W-4, simply hit F2 on the Taxes/Exemptions screen. This changes the exemptions portion of the screen and displays a check box for single/multiple jobs.

The updated screen also displays a wage adjustment field and FWT adjustment amount (the amount of overage will appear here).

How do you squeeze several numbers into these two fields? You can open up a new screen (2020 W-4 direct entry) which is basically the same as the bottom end of the W-4, to enter that data.

We invite you to view a comprehensive demo to assist you with understanding PBS Payroll Software W-4 updates.

To explain the Payroll hot fix changes, the v12.06.05 update documentation was updated and clarified. See V12_06_05_Update.pdf. The user documentation has been updated as well.