PBS™ Payroll Software and the Families First Coronavirus Response Act

Families First Sick and Family Leave

Hello again,

This post is for customers using or those considering implementing our payroll software for small business and mid-sized companies. We hope you find it useful.

Since we first reported that PBS™ Payroll Software supports the Families First sick and family leave requirements by using Special Pay with unique WC codes, we have learned that the first required reporting of such payments and the tax credits for such payments to employees under this law will be included in the second quarterly 941 reports.

We want to assure you that Passport will provide any program changes required for the Form 941 reporting when those reporting requirements are clear.

On March 19, 2020, The Families First Coronavirus Response Act became law throughout the United States and it went into effect April 2, 2020. To read about this new law, as it affects all companies with less than 500 employees, see the links below:

· Families First Coronavirus Response Act: Employee Paid Leave Rights

· Employment Law Provisions of the Families First Coronavirus Response Act

Interpretation

Following is our attempt at interpretation of the law and is not legal advice. Effective April 2, 2020, employers with less than 500 employees must pay emergency sick and/or paid-family-leave monies to employees for COVID-19 related absences. But employers receive tax credits for the amounts paid.

· There are limits on the number of hours and dollars that the employer must pay, so this needs to be tracked.

· And the accretion and recovery of these costs as tax credits also needs to be tracked.

You will need to decide if you agree with this interpretation.

Tracking

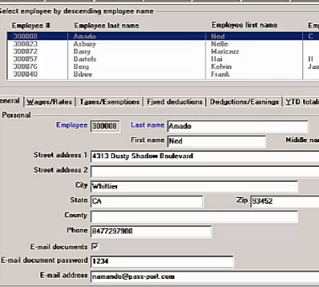

Our Payroll Software currently includes support for payment and tracking of the Emergency Sick Pay and Emergency Leave that employers are required to pay to employees under this new law using the “Special Pay” features.

If you are using the full page graphical checks, or the ACH Direct Deposit feature, the remittance stubs will provide pay details for these special earnings as well.

To track the specific amounts paid under this Act, we are requesting that you set up two new Workers Comp codes in the Payroll Workers Comp code file as follows:

1. COS – This code should be used for COVID Emergency Sick Pay

2. COL – This code should be used for COVID Emergency Leave Pay

Entering Transactions

When entering Payroll transactions the user can enter any G/L accounts related to the employee.

To make your job easier we recommend the following:

1. If you have not yet implemented the PBS Payroll new graphical check or Direct Deposit (ACH) payment with emailing employees secure pay advices, this would be a good time to do so. The older style check forms with top and bottom stubs do not accommodate all data that may be produced. The newer forms do print all the detail. If you choose to continue using the old check forms, consider using separate checks for these payments to employees.

2. PBS Payroll versions 12.04, 12.05 and 12.06 meet the requirements for compliance with this law and any new reports will be for these versions. If you are on an older version, please take this opportunity to upgrade.

To learn more about our payroll software for small business and mid-sized companies call 800-969-7900. Or contact us – we are here to help.