Outsourced vs. In-house Payroll for Small Businesses and Mid-sized Companies

Hello again,

This post is for small to mid-sized companies who may be vetting an in-house payroll system.

The following is sourced from lokisys.com. We hope you find it useful.

“Deciding whether to process payroll in-house or outsource to a payroll provider is big decision. The choice can cost tens of thousands of dollars.

With such a big decision, there are lot of questions you need to ask yourself before finalizing your choice. To help with the decision making process, we’ve created this post to address the top questions you should ask yourself before choosing whether to go with in-house payroll or outsourced payroll.

Control Over the Process

If you’re looking for control over the aspects of your payroll like its timing, and the flexibility to make changes more easily, then in-house payroll may be your best option.

With in-house payroll, you have greater control over each aspect of the pay process, giving you the most flexibility.

It can also be much cheaper and easier to make updates, changes, and adjustments when they are needed.

If you have collective bargaining agreements or other rules that change frequently, in-house payroll may be preferable.

Outsourcing

On the other hand, by outsourcing payroll, you give up some control over the payroll process but you no longer have to worry about doing the payroll process.

Some of the steps, like gathering time and absence information, would likely need performing. And you will still need to double check information before you send it off, and checks after processing, as last minute changes or adjustments may be harder to do with out-sourced payroll.

Pay Periods

Paying people at different intervals such as bi-weekly, weekly and monthly, means frequently sending batches of pay to a third-party for processing.

If you have multiple groups of employees who need to be paid at different intervals, it can be easier to use an in-house payroll solution instead.

If you have only one pay cycle to administer, then out-sourcing becomes less complex.

Last Minute Changes

Maintaining payroll in-house gives you the ability to quickly process a last minute paycheck or, make an off cycle-payment.

When outsourcing payroll, last minute pay may not be processed in time or it may cost you more to be expedited.

Additionally, with outsourced payroll you usually pay per pay check so each additional off-cycle or last minute payment will cost you more.

With an in-house payroll solution, you can process as many additional last minute and off-cycle payments without paying more or running the risk of being unable to deliver them on time.”

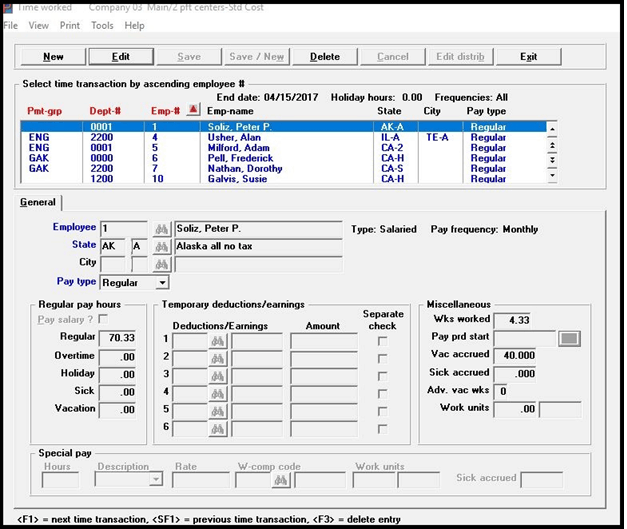

With 35 years of payroll processing experience, Passport Software provides comprehensive yet easy to use in-house payroll software for small businesses and medium sized companies.

The payroll module is part of Passport Software’s accounting software solution.

Call 800-969-7900 – Or Contact Us. We are here to help.