Ongoing ROI with On-premise Software

Advantages of In-House Payroll

Hello again,

Payroll processing can often be a challenging task. The complexity of federal, state, and local regulations can be overwhelming when it comes to correctly paying your employees and meeting regulatory requirements.

If you decide to outsource processing, you are still responsible for collecting necessary data. Even with a payroll service, you still need to verify that hours, supplemental earnings, and deductions are correct.

One issue to consider is the cost of outsourcing payroll, as an external service may result in higher per check costs. Over time costs add up, and it’s important to note if external costs are increasing. In addition, you may be paying costly fees for adjacent services like ACA compliance management.

In-house Advantage

Benefits of on-premise payroll are greater control over the process, the ability to customize it to fit your company’s specific needs, enhanced data security by keeping sensitive information internal, and the potential to save costs by managing it yourself.

– You have full control over every aspect of the process, allowing for adjustments and modifications based on your company’s requirements.

– The ability to tailor payroll calculations, deductions, and reporting to accommodate your company’s unique needs.

– Sensitive employee information remains within your company, minimizing the risk of data breaches from third-party providers.

Depending on the size of your company, managing payroll in-house might be more cost-effective than paying fees to an outsourced provider.

Many businesses are overspending on an external provider and doing most of the work themselves. Our in-house solution can offer ongoing ROI due to cost savings on an external service.

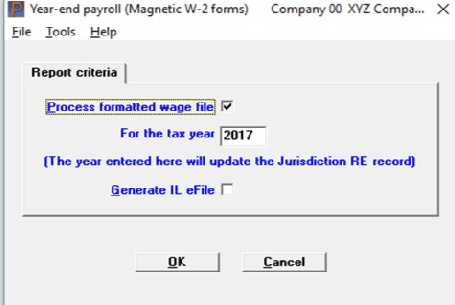

A one-time licensing fee is required for Passport Business Solutions™ (PBS™) Payroll, with a small annual maintenance/updating cost. PBS™ maintains employee data, calculates taxes, handles deductions, and includes ACH direct deposit with remittance advices emailed to employees, or you can always print physical checks.

Our payroll program is affordable, expedites processing, and assists businesses in adhering to local, state, and federal tax laws. Passport Software also provides Affordable Care Act software and reporting services to help you simplify and comply year-round.

PBS Payroll optionally integrates PBS™ Accounting, and with on-premise software, you have control over your software and your server. No one will have access to your employee’s income and employment data unless you provide it.

Advantages of On-Premise Accounting

While cloud-based accounting software as a service (SaaS) solutions are currently popular, many are designed for larger corporations, can be too expensive, complex, and not customizable for smaller to medium-sized businesses.

It is important to consider the total cost of ownership when investing in accounting software. Although the upfront cost of SaaS may seem lower, the recurring monthly or yearly fees can quickly accumulate, making it an expensive option.

With Passport Business Solutions™ desktop accounting, there are no monthly fees to maintain access to your data. A recent review of a well-known subscription accounting software noted, “It seems that without renewing or purchasing a new subscription, we are unable to access any of our historical data. This includes data that goes back decades… It feels like we are being held hostage to our data, which we have invested a great deal in over the years.”

With Passport Business Solutions™ desktop accounting, you have complete ownership of your data and full control over the software and your server. Even when the internet is down, you can still process your financial operations.

You have the flexibility to adjust and improve security measures, such as controlling physical access to your computers and server whenever necessary. Additionally, PBS™ offers robust audit trails that help prevent fraud.

To learn more about our in-house payroll software for small business and mid-sized companies call 800-969-7900. Or, contact us – we are here to help.