We Do Payroll Your Way

Hello again,

This post is for small to mid-sized companies who may be vetting an in-house payroll system. It was written by John Miller, President of Passport Software, and we hope you find it useful.

According to tradingeconomics.com, “The annual inflation rate in the US accelerated to 9.1% in June of 2022, the highest since November of 1981, from 8.6% in May and above market forecasts of 8.8%.” Many small businesses are seeing their total costs go up due to inflation and are adapting in different ways, including raising prices and/or absorbing some of the higher costs.

Businesses are also implementing strategies to trim expenditures, including investing in technology to reduce long-term costs. The effective use of technology, such as implementing comprehensive business software, helps companies streamline their business processes to improve efficiency and help increase profitability.

Many companies are spending far too much time, effort, and money than they need to on an outside payroll service. We provide comprehensive, easy-to-use, and secure in-house payroll processing for small to mid-sized companies to streamline payroll processes.

PBS™ (Passport Business Solutions™) Payroll is an on-premise accounting payroll program that can provide ongoing ROI due to cost savings versus an outside payroll service.

Payroll Requirements

No business function is more basic or more important than payroll. And while some businesses have a relatively simple payroll function, with standard hourly and salary employees, other businesses have more complex requirements including:

· Accounting for direct and indirect tips in food service and hospitality

· Job-based pay rates requiring tracking the different activities of employees working at different tasks or in different departments

· Production statistics for piecework or another production-based payroll

· Incentive-based pay such as commissions

· Shift differentials, weekend, and holiday pay as well as on-call pay

· Payroll checks have largely been replaced by direct deposit/ACH payment or payroll debit cards improving security and ease of access

· And today, employees are more than ever, requesting pay advances, especially if they are Gig or occasional part-time workers

On top of the industry and contractual factors, the increase in benefits accounting includes 401-K and Roth contributions, PTO/vacation/holiday/sick pay accruals, health savings accounts and insurance, expense reimbursement and tracking, and taxation compliance with ever changing rules by states, counties and cities if your employees work at multiple locations. Whew! How do we keep it all going?

Manual Tracking

To handle all the “special requirements” many companies employ a small army of spreadsheets that track and summarize all of the details needed to comply with the pay policies or union contracts and other details.

These spreadsheets get increasingly complicated over time as the rules shift until it evolves into a full-time job for one or more staff members. And God help us if this person gets sick, goes on vacation, or after several decades decides to retire.

Well, there is a better solution, one that will save time and result in a more manageable payroll process and it involves automating all those spreadsheets and rules so that payroll data is quickly and accurately processed through the policies or contractual rules and they are applied correctly every time.

How does this work? The following steps illustrate the process:

1. Employee Time Management. It is key to implement a robust time tracking or time clock solution. Our solution is TimeClick® which supports both desktop/laptop and mobile phone devices for basic functions like clocking into and out of work or to specific departments or jobs. The detail time records update a data base which supports administrative and reporting functions to manage the individual and overall employee record keeping. TimeClick® also warns you when people are approaching overtime to help manage labor costs. It also prepares for the next steps.

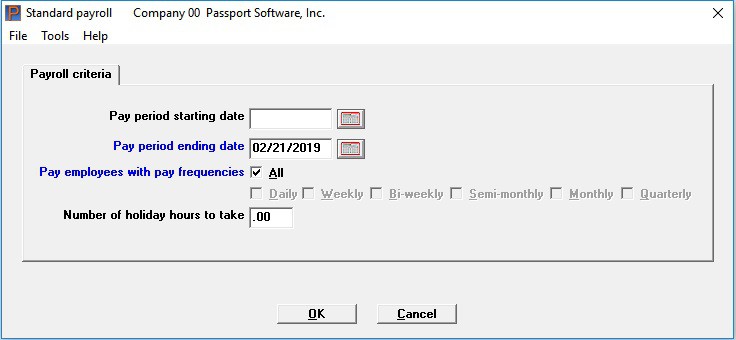

2. Payroll Preparation. Review company policies and contract requirements and determine rules to be applied to the time records in preparation for payroll. This is where the policies and contracts that are encoded in spreadsheet rules are examined to determine processing rules for the programs that form the bridge between time records and the payroll preparation. This is a software program that is configured specifically for your company’s needs.

3. Preliminary Payroll Calculations. Import the payroll data including the results of the previous step and calculate the actual pay. Review with management to make sure it is correct. After any necessary corrections or adjustments, the final step is to run the payroll.

4. Processing the payroll and distributing the earnings used to mean printing checks. Due to significant levels of fraud or delay in the postal services, most companies are using the electronic banking features of ACH to directly deposit the employees’ net earnings into one or more accounts per employee. Some companies also offer a Debit Card usually branded Mastercard to load some or all of the net pay onto. This tends to make it easier for employees to spend or get cash. If employees have been standing in line at a bank or currency exchange, this is a big improvement.

5. After payroll is complete, taxes are reported for payment, ACA (Affordable Care Act) Monitoring reports if part-time employees are approaching full-time work levels, and expenses are recorded for the financial statements and bank account entries are added to the checkbook. The last two depend on use of PBS™ General Ledger and Check Reconciliation packages.

This gives you a soup to nuts solution to the payroll process and reduces the manual effort required. It also produces a well-documented procedure manual to help you manage the area.

Advantages of On-premise Payroll

Implementing on-premise payroll software can save your company money, offer more flexibility, and may provide better security than an outside payroll service.

After you pay the up-front fee to license and implement the software (and nominal annual fee for maintenance/updates) cost savings on an outside payroll service can pay for the software over time and provide you with ongoing ROI.

Our in-house payroll program allows you to control the entire payroll process. Desktop payroll software enables you to make last minute-changes, and you can process payroll on your own schedule.

Also, a payroll service may charge additional fees for adding overtime, adjusting shifts, and they can increase the cost of their services at will.

PBS™ Payroll is cost-effective, streamlines payroll processing, and helps companies maintain compliance with federal, state and local taxation. Flexible, automated features accommodate a variety of payroll needs.

Learn more about the features and benefits of implementing PBS™ Payroll. Or, contact us – we are here to help.