Considerations for Selecting Your Payroll Solution

Hello again,

This post provides food for thought concerning the choice of an in-house payroll system vs. an outside payroll service; covering advantages and disadvantages of the two approaches.

While we admit a certain bias in favor of the in-house option, and of course PBS™ Payroll will be mentioned, here are some helpful tips for selecting your payroll solution.

Compliance

Payroll processing can be a hassle. The increasing compliance burden of federal, state, and local regulations, their complexity, hard deadlines, lack of standardization across multiple states with wildly different requirements, are all anxiety-producing hurdles in correctly paying your employees and the regulators on time.

In AP or AR if you mess up and miss a payment or underpay a vendor or overbill a customer there will be an email, or a phone call and some presumably amicable and easy remedy will be made. Not so for payroll.

And this may be the underlying theme in this piece – even if you off-load running checks or producing the 941’s or W2’s in favor of a PR service, the responsibility and liability still ends with you.

This is not to say that there are not good reasons for moving off an in-house system, but saving time is not that reason.

HR System

Data collection is still your responsibility with an outside payroll service. However, one benefit of using a payroll service is that it may provide an HR system.

One of the attractive features of many online HR systems is the employee self-service function that allows employees to make changes – to their address, marital status, insurance coverages, report the birth of child, and more.

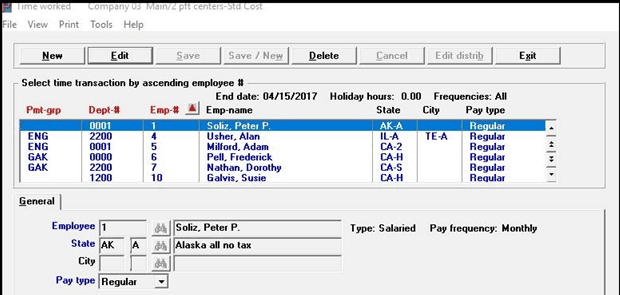

Passport Software has been adding HR-like functionalities, such as importing time worked transactions from timeclock systems such as TimeClick®, retaining employee wage and employment history data, and Affordable Care Act compliance functionality. However, PBS Payroll does not provide a full HR system.

So, what are the issues that might be misunderstood about in-house versus outside Payroll service?

Outsourcing PR Costs

Affordability can become an issue when using an outside payroll service:

• Per check costs are typically 2 to 4 times higher with a service, e.g., $.75 to $3.00.

• In some cases, utilizing a service may save the cost of a full-time employee to process payroll inhouse.

Eliminating a higher-earning position can be tempting, and the right choice for some businesses, but you still must have someone in-house to collect and manage the data.

Deadlines

Some people assume that going with a payroll service will remove or lessen the stress of the deadlines involved in getting the checks out on time. But the subtle point here is that this deadline is replaced with a different one or even two deadlines – related to the requirements of getting the edited/reviewed data to the payroll service several days before checks are cut.

Whatever the source of your payroll data, there is always data entry involved whether it’s time sheet data or, for regular salaried employees, adjustments, holiday and bonus pays and garnishee changes. These will be required by a scheduled date/time for each pay period; after which a preliminary or draft payroll is run by the service.

This draft is then reviewed by you, and updates must be submitted by a second cutoff which makes it somewhat more complicated than with an in-house system.

If you are using time clocks with an automatic data feed, you typically have an additional step which does not go away by using a service. The time clock manager must still review the punches and certify the time clock feed.

Often not included

Additional labor costs may be a consideration when using an outside payroll service:

• Services do not typically cover associates to manage garnishes, loans, insurance, benefits, and similar personnel matters.

• Planning, advising, and helping out with filing issues will typically remain in-house. If you eliminate internal payroll personnel, who will absorb these “extra” duties/costs?

Responsibility

Unfortunately, we have seen more than one organization discover that their service bureau had kept the tax deposits for many months, leaving the employer on the hook for taxes, penalties, and interest. Trust but verify should be the rule. Even payroll service users need an experienced and detail-oriented payroll person.

• Hours, supplemental earnings, deductions, and other data are still supplied by you, on the servicer’s schedule. And you still must take full responsibility for accuracy and timeliness.

• W-2 and 941 submissions may be automatic, but how do you know if they are correct?

• If a payroll service does not pay Federal/State withholding taxes on time (or at all), the employer is fully responsible for the consequences.

Knowledge

In-house Payroll software requires periodic updates to keep up with the ever-changing State and Federal regulations. An in-house payroll pro needs to stay informed and aware of all these changes.

Payroll Services employ teams of specialists to monitor changes and compliance, and these services do a terrific job staying on top of these changes.

However, having a go-to payroll employee can really pay off when trying to figure out how those changes apply specifically to your business.

Other Considerations

Both an in-house payroll solution and an outside service have benefits. However, here is one last consideration, things happen – a power outage occurs or someone forgets to report hours on time, and these lead to deadline anxieties.

And surely this varies from provider to provider, but what level of “service” does the payroll service give?

Recently a customer shared that their outsourced payroll direct deposit was delayed by the processor by 48 hours due to a holiday, creating havoc with his employees.

Trusting your business and employee data details being shared with others is always risky, and in this cybersecurity driven society, keeping payroll in house works very well for many of our customers.

To learn more about our in-house payroll software for small business and mid-sized companies call 800-969-7900. Or, contact us – we are here to help.