Performing Regular Bank Reconciliations

Hello again,

This post is for accountants and bookkeepers. The following is sourced from The Art of Bank Reconciliation: A How To Guide for Small Businesses. We hope you find it useful.

“There are four compelling reasons why you need to perform regular reconciliations:

See your business as it really is

When you look at your books, you want to know they reflect reality. If your bank account and your books don’t match up, you could end up spending money you don’t really have—or holding on to the money you could be investing in your business.

Track cash flow

Managing cash flow is a part of managing any business. Reconciling your bank statements lets you see the relationship between when money enters your business and when it enters your bank account, and plan how you collect and spend money accordingly.

Detect fraud

Reconciling your bank statements won’t stop fraud, but it will let you know when it’s happened.

For instance, you could pay a vendor by check, but they could tamper with it, making the amount withdrawn larger, and then cash it. The discrepancy would show up while you reconcile your bank statement.

Or you might share a joint account with your business partner. When they draw money from your account to pay for a business expense, they could take more than they record on the books. You’d notice this as soon as you reconcile your bank statement.

Hopefully you never lose any sleep worrying about fraud—but reconciling bank statements is one way you can make sure it isn’t happening.

Detect bank errors

It’s rare, but sometimes the bank will make a mistake. If there’s a discrepancy in your accounts that you can’t explain any other way, it may be time to speak to someone at the bank.”

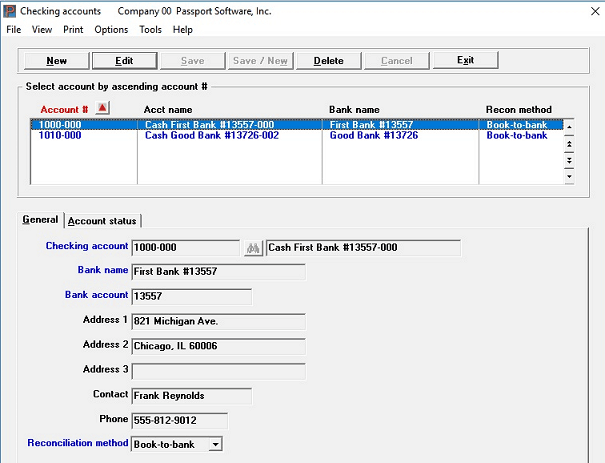

Passport Software’s Check Reconciliation Software provides audit trails that help protect against fraud. Our CR software also safeguards against getting your information out of balance or getting tangled up during the reconciliation process.

Call 800-969-7900 to learn more. Or Contact Us – We are here to help.