Accounts Payable Software for Small Businesses & Mid-Sized Companies

Passport Software’s Accounts Payable program can help you maintain your good credit rating by managing your cash wisely. Keep accurate information on vendor, supplier and costs by tracking payment due dates, available discounts, and money owed to creditors.

- An unlimited number of AP accounts and cash accounts may be used.

- Allows vendor terms and aging of accounts based on days or on day of month (proximo).

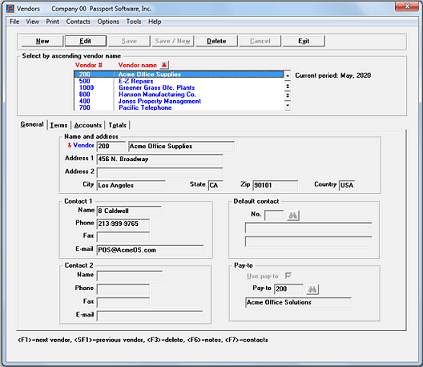

- Handles vendors with multiple payment addresses and multiple contacts.

- Allows recurring payables based on flexible criteria.

- Allows flexible payment selection, including partial payments, with a check selection edit list and Memo Payment tracking.

- Tracking of purchase memos provides reporting of amounts purchased through credit cards.

- Track past, current and future payables to creditors. Document management for PBS™.

AP Checks

The Accounts Payable software for small business module prints AP checks and a check register. Checks can be generated immediately, a convenient feature for COD deliveries. This also facilitates receivings and reduces manual check writing and repetitive data entry.

- Enter and track the kind of “purchased from” but “paid to” information involved with credit cards, factoring, sales tax and similar transactions.

- Enter and track sales tax paid on out-of-state vendor purchases which may be used to reduce the use tax liability for any state.

- Match vendor invoices against PO receipts and validate any changes against PO amount, requiring an override if different.

- Pay selected vendors via ACH direct deposit. With ACH direct deposit, the mailing of checks is not required, adding an additional layer of security that the “check will not get lost.”

- Void check processing is available for lost checks.

- ACH payments for electronic AP disbursements.

- Keeps a full vendor history showing the details of all entry and payment activity for as long as you want to keep it.

- When you associate the pay-to address with a vendor, the pay-to address is printed on the vendor check.

Positive Pay Records

Our small business Accounts Payable software creates Positive Pay records for transmission to your bank for an effective anti-fraud tool for check disbursements.

ACH direct deposit payments for electronic AP disbursements.

- Keeps a full vendor history showing the details of all entry and payment activity for as long as you want to keep it.

- When you associate the pay-to address with a vendor, the pay-to address is printed on the vendor check.

- Printing with Accounts Payable.

- Print 1099s for a range of vendors.

- Label printing provides the printing of a return address or vendor mailing label.

Many standard Accounts Payable reports are available including Purchase Journal, Cash Disbursements Projection, and Cash Requirements forecasts by time periods.

Vendor invoice history is available for viewing or report printing. When viewing an invoice, drill down to the assigned distributions.

1099 MISC types are tracked. 1099s can be printed and e-filed for easy compliance with year-end tax requirements.

When interfaced to Check Reconciliation you have the option to automatically post payments to the Check Reconciliation checkbook.

May be interfaced to Passport Business Solutions General Ledger, Job Cost and/or Purchase Order, Check Reconciliation, NCR Counterpoint or used stand-alone.

Call 800-969-7900 to learn more about PBS™ Accounting or our Accounts Payable software for small business.