Our ACA Software and Services – Who We Help

Simplify ACA Compliance Management for Your Company

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

Passport Software helps all types of ALEs simplify ACA compliance management and filing. Since 2015, our ACA software and services have helped ALEs comply with IRS reporting requirements accurately and efficiently.

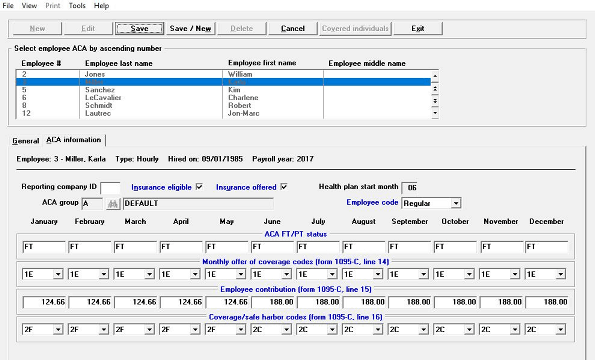

Our IRS-approved ACA software allows you to monitor employee statuses, alerts when offers of coverage are needed, simplifies filing, and helps you comply with the ACA year-round.

– Passport™ ACA Corporate Edition allows you to meet the electronic filing requirements of the IRS and if you prefer, we can do it for you.

– For multiple EINs under common ownership, Passport™ ACA Enterprise Edition provides the IRS consolidated electronic reporting requirements for two to two thousand separate companies.

We are IRS-certified for optional proxy submission on behalf of our software customers, and with our ACA Full Service option, we do everything for you year-round, including filing.

IRS Levy Power

ACA reporting deadlines have passed, but the IRS continues to issue penalties for non-compliance. In addition, the IRS has levy power to collect on outstanding ACA penalties.

According to the IRS, “An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.”

Our ACA software and services can help you simplify and comply year-round to avoid potentially costly penalties. We also provide penalty response consultation services and have helped many companies avoid or drastically reduce penalties.

Avoid Penalties

ACA compliance and filing mistakes can be costly. It’s important for your company to maintain compliance throughout the year, accurately track data, and file in a timely manner.

If you receive an IRS warning or penalty notice, make sure to review the information to ensure it is correct. Keeping accurate records will help you review your ACA-related data, offers of coverage, and filing information. Maintaining accurate records year-round is crucial for disputing an ACA penalty, and the IRS will need to verify your supporting documentation.

If you need to request an extension, be sure to explain why, and it’s safer to overexplain rather than omit any potentially relevant details. It is important to respond to notices and submit the payment in a timely manner. However, if you dispute the penalty assessment, you will need to prove your case with supporting documentation.

Make sure to track and document your communications with the IRS throughout the appeal process. If you need assistance, our friendly experts can help you with responding to penalties, late filing, and answering any ACA-related questions.

Our IRS-certified ACA software or ACA Full Service option aggregates your data in one silo, making documentation easy to access for an extension request or appeal.

Passport Software

Passport Software’s ACA software and services can help you maintain year-round compliance and avoid costly penalties.

– Passport Software’s IRS-certified ACA software is easy to use and helps you maintain compliance year-round.

– We are also IRS-certified to file on behalf of our software customers.

– Our ACA Full Service option is the easiest – just provide a spreadsheet with employee data, and we do the rest, including filing.

– We also provide penalty response consultation services and have helped many companies avoid or drastically reduce penalties.

To learn more about how our ACA software and services can ease the burden of compliance, call 800-969-7900. Or, contact us – we are here to help.