Our ACA Software and Services Help ALEs Maintain Compliance Year-round

Simplify Affordable Care Act Compliance Management

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

We’ve recently received a few calls from companies that have gotten IRS penalty letters for failing to file ACA information returns.

One thing some of these callers had in common was failing to monitor part-time employees trending towards full-time. Even if the number of full-time employees working at a company is currently below 50, employees trending towards full-time could ultimately result with 50+ full-time staff.

If you fail to offer appropriate health coverage to qualifying employees and their dependents, penalties could be steep. Our ACA software provides reports that indicate when part-time employees are trending towards full-time, so you can provide appropriate offers of coverage.

Our ACA Full Service is the easiest option – we do it all for you throughout the year including filing. We can help with late filing, failure to file in prior years, and answer any questions about the ACA in general. We also provide penalty relief consultation services and have helped many companies avoid or drastically reduce penalties.

If you are manually tracking, underwhelmed by your current ACA solution, or overwhelmed with compliance management, we can help.

ACA Software Streamlines Compliance Management

Affordable Care Act compliance can be complex, and Passport Software can help you through the entire process. Our IRS-certified ACA software helps you streamline reporting and managing ACA-related data year-round. And, we are IRS-certified for optional proxy submission on behalf of our software customers.

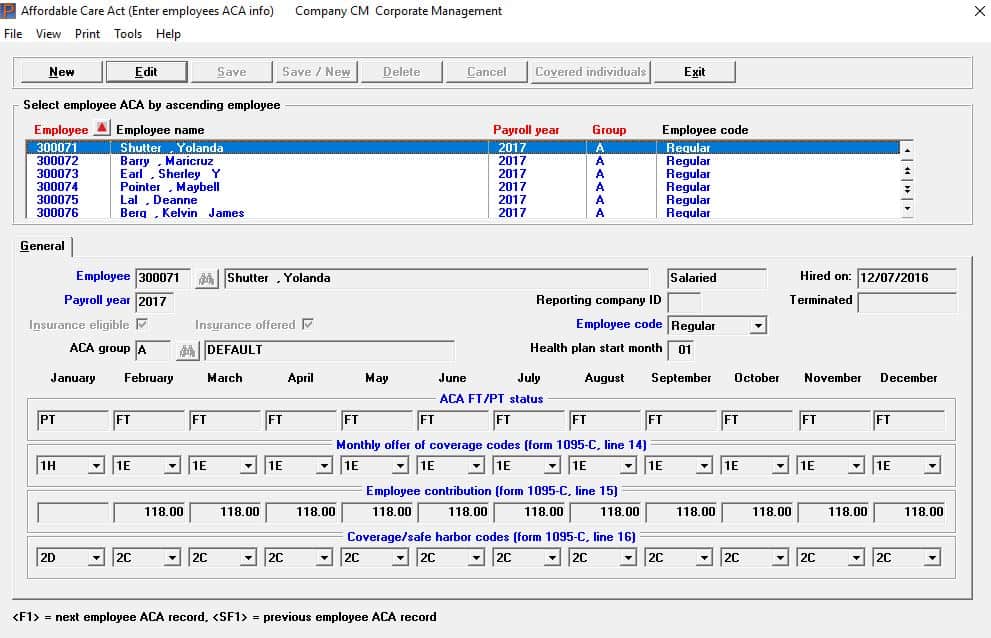

Our comprehensive ACA software is much more than a forms-only solution. The easy-to-use dashboard closely resembles form 1095-C, and our software helps you easily monitor and maintain compliance throughout the year.

If you are manually tracking, automation and aggregating your data in one silo streamlines compliance management and can help ensure data accuracy.

Passport Software’s IRS-certified ACA Software helps you comply with ACA mandatory reporting throughout the entire year and provides automated 1094/1095 filing. It alerts when an offer of coverage will be needed, and it helps ensure that coverage falls within the affordable range based on IRS criteria.

We are also IRS-approved for optional proxy submission on behalf of our ACA software customers. Our experts can walk you through the entire ACA compliance and reporting process, provide current regulatory expertise, and excellent training and support.

ACA Full Service is the Easiest Option

Our ACA Full Service is the easiest option – just provide a spreadsheet with employee data, and we do it all for you throughout the year including filing. We handle initial data import of employee information, and generate employee records to track when offers of coverage are needed.

Passport Software’s ACA Full Service provides data tracking and compliance management year-round, and we prepare, furnish, and file your ACA information returns.

For companies with a lot of turnover or, that need to keep a close eye on full-time/part-time identifications, additional administrative services are available a la carte by purchasing support time:

– Maintaining termination dates

– Adding new hires

– Changing ACA offer codes and contribution amounts

– Corrections including data entry and new electronically filed corrections with confirmation

Periodic management reporting is provided to the client. These reports are likely to be full-time/part-time status monitoring from our measurement period reports, but may also include insurance cost analysis or custom reports.

ACA Software Integrations

Passport Software’s ACA software can be a standalone solution or optionally integrates with PBS™ Payroll, an optional module included in the PBS Accounting suite. TimeClick is reliable and easy-to-use time clock software that easily interfaces with PBS Payroll.

PBS™ Accounting is a scalable modular solution, so you can add-on as you grow. Robust and affordable for small to mid-sized companies, in-depth reporting provides a better analysis of your financial data for better decision making.

PBS Accounting also integrates with PBS Manufacturing and PBS Distribution, so if your shop or warehouse has grown into an Applicable Large Employer (50+ full-time employees) our optional ACA software can help you manage ACA compliance year-round.

Expert Assistance

Our friendly experts can help you select the best solution for your company and answer any questions about our ACA software and services. We can answer questions about the ACA in general, including questions about IRS measurement periods and IRS affordability and safe harbor determination.

Restaurants employing staff with variable hours, staff working at more than one location, or employees with varying pay rates must take measures to track employee hours accurately. Companies with temporary or seasonal workers, and businesses with new hires and re-hires need to ensure they are monitoring employee status accurately.

It’s important to remember that under the ACA, 40 hours per week is not the threshold for full-time status. To be considered full-time under the ACA, employees need to work 30+ hours a week or 130+ hours a month.

Offers of coverage must be made in a timely manner, depending on the measurement method, and plans must be considered affordable under IRS criteria. Keeping your payroll records organized can help ensure you make the proper employee classifications. It is also important to re-offer healthcare benefits at the beginning of every plan year.

Our IRS-certified ACA software provides visibility across your ACA compliance management and reporting activities. Our ACA Full Service is the easiest option, and we also provide penalty response consultation services and have helped many companies avoid or drastically reduce penalties. We can help with late filing, back-filing, and resolving data mismatch or coding errors.

To learn more about our ACA software and services, call 800-969-7900. Or, contact us – we are here to help.