Illinois Employers Required to File Electronically: W-2, W-2c, W-2G, 1099 Returns

W2 Electronic Filing – Illinois Employers

Hello again,

This post is for our current PBS users. We hope you find it useful.

The State of Illinois now requires that all Illinois employers file the W-2, W-2c, W-2G and 1099 returns electronically. Passport will be providing a custom installation solution so that you can file electronically.

Be sure to upgrade/update to 12.05.03 and contact Passport to receive this custom installation. The custom programs are expected to be ready the second week of January 2018.

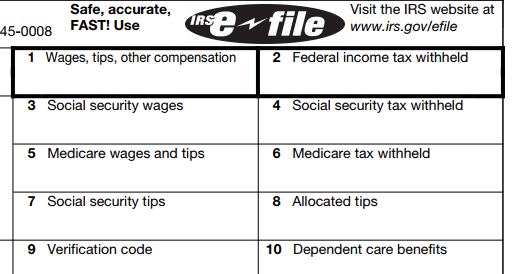

Illinois requirements – “Effective for the 2017 Tax Year: Electronic filing of the W-2, W-2c, and W-2G is MANDATORY – Due date January 31, 2018. You must electronically file your W-2s, W-2cs, W-2Gs, and 1099s using one of the methods described below:

Electronic filing methods for Forms W-2 and W-2c

Payroll providers and employers must file W-2 and W-2c returns with Illinois using

- Forms W-2 and W-2c Electronic Transmission Program Your file must be developed following the Social Security Administration’s Specifications (EFW2 and EFW2C) for Filing Forms W-2 Electronically, and the additional Illinois requirements in our W-2 and W-2c Electronic Transmission Guide, or

- MyTax Illinois You must enter the information on MyTax Illinois for each form, one form at a time. If you do not have a MyTax account, you must sign up for one. You will need to log into your MyTax account to enter all of the information on the W-2s or W-2cs and submit to Illinois. This method is ideal for employers that have a small number of employees and do not want to use third-party software.

Electronic filing methods for Forms W-2G and 1099

Payroll providers and employers must file Forms W-2G and 1099 returns with Illinois using

- W-2G and 1099 Illinois FIRE Electronic Transmission Program (coming soon) – Your file must be developed following the Internal Revenue Service’s (IRS) Filing Information Returns Electronically (FIRE) format, and the additional requirements in the W-2G and 1099 Illinois FIRE Electronic Transmission Guide (coming soon), or

- MyTax Illinois – You must enter the information (only 1099-R and 1099-MISC at this time) on MyTax Illinois for each form, one form at a time. If you do not have a MyTax account, you must sign up for one. You will need to log into your MyTax account to enter all of the information on the W-2Gs or 1099s and submit to Illinois. This method is ideal for employers that have a small number of employees and do not want to use third-party software.”

Learn more here or contact your Passport Partner. Our direct end-users can Contact Us – We are here to help.