What is a Full Time Equivalent Employee (FTE)?

Full-time or Full-time Equivalent?

Hello again,

The Affordable Care Act requires employers to calculate business size based on two factors: the number of full-time employees that an employer has and the number of full-time equivalent (FTE) employees they have.

According to the IRS:

A full-time employee for any calendar month is an employee who has on average at least 30 hours of service per week during the calendar month, or at least 130 hours of service during the calendar month. Applicable Large Employers must use a monthly measurement period to determine full-time status.

Exceptions to FTE status

When determining if an employer is an ALE, the employer must measure its workforce by counting all its employees. However, there are several exceptions.

Seasonal Workers

A seasonal worker is defined as an employee who performs labor or services on a seasonal basis. For example, retail workers employed exclusively during holiday seasons are seasonal workers. An employer is not considered to have more than 50 full-time employees (including full-time equivalent employees) if both of the following apply:

- The employer’s workforce exceeds 50 full-time employees (including full-time equivalent employees) for 120 days or fewer during the calendar year

- The employees in excess of 50 employed during such 120-day period are seasonal workers

Ownership

The following individuals are not considered employees:

- Owners of the small business, such as sole proprietors, partners, shareholders owning more than 2% of an S corporation or more than 5% of a C corporation

- spouses of these owners

- family members of these owners, which include a child, grandchild, sibling/step-sibling, parent or ancestor of a parent, a step-parent, niece/nephew, aunt/uncle, son-in-law/daughter-in-law, father-in-law/mother-in-law, brother-in-law, or sister-in-law

- A spouse of any of these family members should also not be counted as an employee

Definition of an FTE

A full-time equivalent is a combination of employees, each of whom individually is not full-time, but collectively are equivalent to a full-time employee.

The following method is used to calculate how many FT and FTEs an employer has, for the sole purpose of determining Applicable Large Employer (ALE) status:

- Ownership and seasonal workers who meet the above definition of a should not be included in this calculation

- Anyone who is designated as full-time by the employer is counted as FT

- Anyone who works 130 or more hours during that calendar month is counted as FT

- All other employee hours for the given month are pooled, then divided by 120, with any fractional remainder ignored (Example—35.82 would be 35)

- The combined total of FT and FTE employees for a month = B + C + D

If the monthly FT + FTE average for a calendar year is 50 or more, then the employer will be considered an ALE and subject to the requirements of the Affordable Care Act for the entirety of the following calendar year. An ALE need not offer minimum essential coverage to its part-time employees.

Simplify ACA Reporting

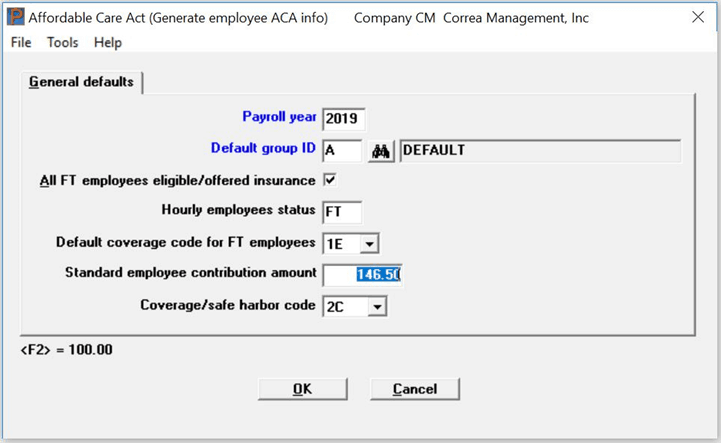

Passport Software’s ACA Compliance Software:

– Protects your business from costly reporting errors

– Monitors employee status throughout the year

– Simplifies Reporting

Learn more about Passport Software’s ACA Software or Contact Us.