Passport Software Offers Transmission Services for W-2s and Form 1099

Hello again,

This post provides instructions for the IRIS (Information Returns Intake System) registration process – we hope you find it useful.

By now, hopefully everyone is well aware of the new ten-form electronic Federal filing threshold for W-2s, 1099s, and 1095s.

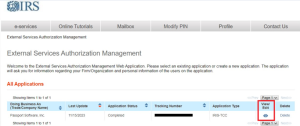

This means if you have nine W-2s and one Form 1099, you will be required to file both electronically. The IRIS (Information Returns Intake System) registration process can take several weeks, so Passport Software customers should already be working on this.

As we have done for Affordable Care Act filing, Passport Software will offer our customers transmission services for W-2s and 1099s as a convenience for those who do not want to go through the IRIS TCC application and e-file Forms 1099 on their own.

ID.me login (individuals)

1. Create an identity verification account at id.me. While this post deals primarily with your IRIS TCC application and e-filing Forms 1099, you should know that these credentials are also used to log in for…

a. W-2 filing using the Social Security Administration’s Business Services Online (BSO)

b. 1094-C/1095-C Affordable Care Act filing with IRS e-Services.

IRIS TCC (Company, with digital signatures of all Responsible Officials)

2. Go to https://www.irs.gov/filing/e-file-forms-1099-with-iris and click the IRIS Transmitter Control Code (TCC) or Access IRIS Application for TCC link seen below, which will direct you to sign in using ID.me credentials first.

3. Complete your application, with your organization identifying at least two Responsible Officials and at least two Contacts. These may be the same or different individuals. Click this IRIS User Guide for additional information.

4. Once your IRIS TCC application is complete and moved from Testing status to Production and you are ready to e-file Forms 1099, log in to the IRIS Portal.

Live e-file Forms 1099

5. Sign in to IRIS button and enter your ID.me credentials.

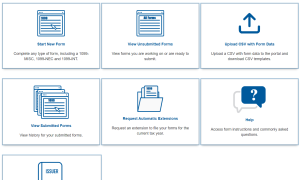

6. Select the Organization (you may have additional options such as ACA or TIN Matching). Your IRIS dashboard will look like this:

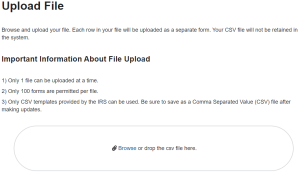

7. The Upload CSV with Form Data option will be used for your PBS 1099 NEC or MISC file.

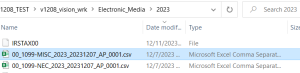

8. Browse or drag and drop your file. PBS creates your 1099 MISC and 1099 NEC files in a location as below. From your PBS install, navigate to the Electronic Media>>2023

PBS file location:

9. Record your Receipt ID, allow for processing time, then check on the status to confirm all files were accepted.

For questions about Passport Software’s transmission services for W-2s and 1099s for our customers, please call your Passport Partner at 800-969-7900. Or, contact us – we are here to help.