Comprehensive ACA Software and Services Help to Avoid Penalties

Employer Shared Responsibility Payments Adjustments for 2023

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

The IRS has updated the Employer Shared Responsibility payment amounts for 2023, and it’s crucial for ALEs to manage data effectively to maintain compliance in order to avoid potentially steep penalties. Comprehensive ACA software or outsourcing compliance to an expert ACA Full Service provider can help your company remain compliant under the ACA.

The American Payroll Association explains, “Under the ACA, applicable large employers (ALEs) that do not offer minimum essential coverage (MEC) or offer it to fewer than 95% of their full-time employees (and their dependents) owe an ESR payment equal to the number of full-time employees (not full-time equivalents) the employer employed for the year (minus up to 30) multiplied by $2,880 for 2023, as adjusted annually for inflation, as long as at least one full-time employee gets health insurance through an Exchange and receives the premium tax credit.

If ALEs offer MEC to at least 95% of their full-time employees (and their dependents), but at least one employee still obtains insurance through an Exchange and gets a premium tax credit, the employers’ payment is computed separately for each month. The amount of the payment for the month equals the number of full-time employees who receive a premium tax credit for that month multiplied by 1/12 of $4,320 for 2023, as adjusted annually for inflation.

The amount of the payment for any calendar month is capped at the number of the full-time employees for the month (minus up to 30) multiplied by 1/12 of $2,880 for 2023. The cap ensures that the payment for employers that offer coverage to 95% of their employees can never exceed the payment that an employer would owe if it did not offer coverage.”

Avoiding Penalties

The Inflation Reduction Act has increased the IRS budget by $80 billion over the next 10 years, and a drastic increase in hiring is expected. Reports estimate up to 87,000 new IRS agents will be onboarded. This information is sourced from a 2021 Treasury Department estimate of new hires needed to maintain IRS efficacy. However, the actual number of new IRS agents to be hired is still unknown.

If employers are non-compliant with the Employer Mandate, IRS ACA penalty notifications are likely to ensue.

If you are overwhelmed by ACA compliance, manually tracking, or underwhelmed by your current provider, now may be a good time to implement an effective ACA solution in order help ensure compliance. Our comprehensive ACA software and services can help ease the burden of compliance and help your company avoid potentially steep penalties.

Responding to a Penalty Notification

If your company receives an IRS penalty notification, don’t panic. We are here to help, and there are several steps to take upon receiving an ACA penalty notification letter.

First, review the notification carefully and review it several times. Verify that it is addressed to your business, check for errors, and review the date it was issued. In some cases, you can request an extension, and you’ll need to explain why you need it in your response. Companies are given one 30-day extension for those approved to be allotted more time by the IRS.

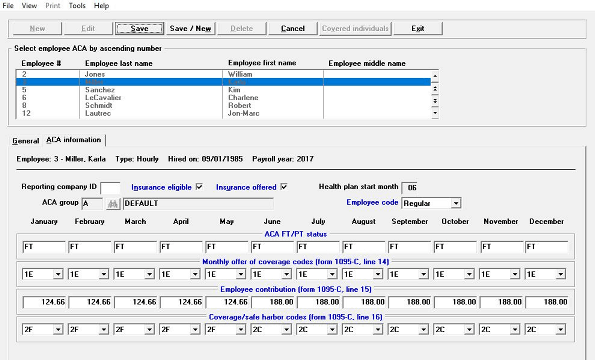

Gather your ACA records and review your 1094/1095-C filings, coverage offerings and affordability. Your supporting documentation will be key if you are disputing the penalty. Our IRS-certified ACA software helps you aggregate and track ACA data year-round to help avoid penalties.

Our ACA Full Service option is even easier, just provide a spreadsheet with employee data, and we do the rest, including filing. Our helpful ACA experts are here to answer any ACA-related question that you might have, and we provide penalty response consultation services.

Passport Software

Passport Software is an IRS-approved ACA software vendor and transmitter, a service provider, and a consulting resource.

Our ACA software or Full Service option can help you maintain compliance year-round. The Full Service option includes filing, and we are IRS-approved for optional proxy submission on behalf of our ACA software customers.

If you have made a good-faith effort to comply but received an unexpected or larger than expected penalty, we can analyze your compliance and help you contest and respond to your penalty notification.

Letter 226-J is the IRS notification that you have been assessed an Employer Shared Responsibility Provision penalty which can be costly. Our penalty response consultation services have helped many companies avoid or drastically reduce penalties.

To learn more about our ACA software and services call 800-969-7900. Or, contact us – we are here to help.