Affordable Care Act Penalty Relief Consultation Services

Working With the IRS

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. The following was written by Adam Miller, Passport Software’s ACA Specialist and HR Compliance Manager. We hope you find it useful.

“I’m from the IRS, and I’m Here to Help.”

This line has been around forever and used as a joke, but there is truth in this statement, as working on Affordable Care Act compliance with the IRS has taught me.

The IRS Does Want to Help

Here is what I’ve discovered over the past six years working with folks at the IRS:

– Feedback from IRS employees has been instrumental during the certification process of our ACA software and our efforts to perfect it.

– They understand that this legislation is complex and they truly want to help us understand it, file correctly, and help clients avoid penalties.

– They tend be very reasonable when they see taxpayers who are honestly trying to comply but have made reporting errors which have resulted in penalties.

– Penalties are typically forgiven when the mistakes are corrected.

– If the employer has acted in good-faith, the IRS has consistently shown leniency over extra or discretionary penalties for being late or for “willful disregard”.

Letter 226-J

For example, we are occasionally contacted by panicked businesses when they receive 226-J Letters assessing a quarter million-dollar penalty.

After becoming clients, we review their letters and their original filings and have been able to identify their honest mistakes and explain those to the IRS on their behalf.

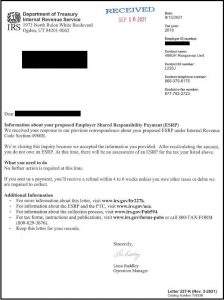

In most of these cases, wrong codes could be corrected and penalties completely rescinded, such as this one forwarded to us just this morning.

Occasionally, a smaller-than-assessed penalty is warranted. The IRS allows for some flexibility and we have been able to minimize the damage.

Work With the IRS

Sometimes a company has done everything correctly, but still receives the ESRP because an employee made the mistake of claiming a Premium Tax Credit (PTC) they were not entitled to.

It is still the employer’s responsibility to demonstrate that the coverage was correctly offered. My most important message is “Confront this issue and take the first steps toward compliance. Work with the IRS.”

If you have a concern about a past filing, or failed to file for whatever reason, don’t wait and hope they won’t come after you. They are methodically crunching through their massive data bases to identify non-compliant companies.

We consistently receive new calls from companies needing help because they have received IRS requests for expected 2019 and 2020 ACA filings.

The IRS is catching up, so take the first step. It will increase your odds for an amicable resolution.

ACA Penalty Response Support

Passport Software provides penalty response support, and a free 30-minute assessment can help determine if you could benefit from our penalty relief consultation services. We’ve helped many clients completely avoid, or greatly reduce, penalties.

Late filing of forms 1094-C and 1095-C or failure to furnish these forms to employees can result in penalties that might be waived if you provide “reasonable cause” (circumstances beyond a filer’s control). You must have made a reasonable attempt to file before and after late filing.

A large employer who does not offer health insurance coverage to substantially all (95 percent) of its full-time employees and their dependents could potentially be subject to a penalty tax. This Employer Mandate penalty may possibly be waived if you can demonstrate to the IRS that you made a qualifying offer of coverage, although an employee accidentally reported otherwise.

Also, the IRS may waive or reduce ACA penalties caused by errors in reporting.

If your company has received an IRS notification of possible ACA penalties, call 800-979-7900 to learn more about how our ACA Penalty Response Services can ease the burden of responding to the IRS.

To learn more about how Passport Software’s ACA Software and Services can help ease the burden of year-round compliance, contact us – we are here to help.