Affordable Care Act Software and Reporting for Employers

Our ACA Software and Services Streamline Data Management and Filing

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

Many of our ACA customers tell us that they found Affordable Care Act data tracking and reporting to be overwhelming, burdensome, or a “hassle” before they found us.

Applicable Large Employers face many ACA compliance challenges, and it’s important to stay on top of requirements and changes over time.

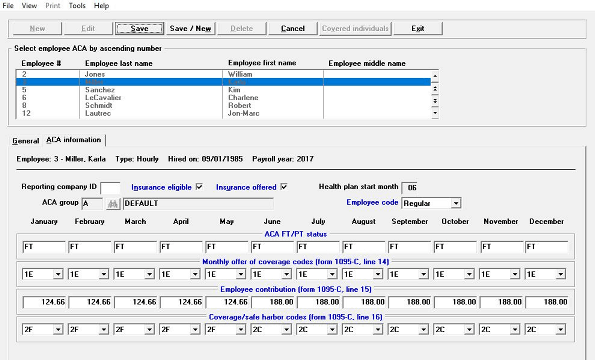

One difficulty is that there are many facets of compliance management such as coding properly, accurate data tracking, appropriate and affordable offers of coverage, and year-round data management.

ACA Compliance Software and Reporting for Employers

Companies may not have a designated ACA point-person or enough staff to ensure the details are managed effectively. Many of our customers rely on our ACA software and services to alleviate the stress and time spent on year-round data tracking.

Passport Software helps employers simplify Affordable Care Act compliance and reporting to avoid costly penalties. Our customers also say they are grateful for our support and help answering questions about ACA-related issues. We help our clients ensure that data management is accurate in order to ensure appropriate offers of coverage.

Common mistakes include employee misclassification and affordability calculation errors. Our friendly experts can walk you through the entire process to help you avoid errors and costly penalties.

Our affordable ACA software and services help ensure compliance year-round, so employers will be ready for reporting deadlines.

Furnishing and Reporting Deadlines

Meeting the filing deadlines for Forms 1094-C and 1095-C is critical for avoiding penalties. For the 2024 tax year, ALEs must distribute Form 1095-C to each full-time employee by January 31, 2025. New IRS regulations create an automatic 30-day extension for furnishing, which gives employers until March 2, 2025.

The paper filing deadline with the IRS for Forms 1094-C and 1095-C is February 28, 2025. If your company files electronically, which is required for employers with 10 or more forms, the deadline is March 31, 2025.

It’s important to file in a timely manner to avoid late filing penalties, and our Affordable Care Act software and services streamline the entire data management process year-round, including filing.

If you are underwhelmed with an outsourced vendor or costly payroll service, where you are doing most of the work anyway, we can help.

Passport Software

Many ALEs spend too much time and effort managing Affordable Care Act data. Or, they use a costly payroll service but do most of the work themselves. Perhaps you are manually tracking data with spreadsheets which can be prone to error.

We’ve been helping Applicable Large employers maintain compliance and avoid penalties since the inception of the ACA. Passport Software’s IRS-certified ACA software streamlines data management year-round to help avoid costly penalties on behalf of your clients.

– Track employees adding coverage, status changes, and contributions going up or down.

– Our software alerts when an offer of coverage will be needed, and it helps ensure that coverage falls within the affordable range based on IRS criteria.

– The software consolidates an employee’s hours across multiple companies and handles the complex reporting rules affected by common ownership.

The Full Service option is even easier – just provide a spreadsheet with employee data and we do the rest, including filing. We also provide penalty response consultation services and have helped many clients avoid or drastically reduce penalties.

To learn more about how our ACA software and services can ease the burden of compliance, call 800-969-7900. Or, contact us – we are here to help.