PBS™ AP Software for Small Business and Mid-sized Companies

Hello again,

This post is for small to mid-sized companies who may be vetting a new accounting system. We hope you find it useful.

Manual Entry

Your company may be receiving invoices via email, mail, and fax, but regardless of the source, one function of the AP department is to process invoices in a timely manner.

If your company is still processing invoices manually, the process may involve various tasks such as manual invoice processing, making payments, verification that the payee has received the funds, check book record-keeping and filing.

Or, some businesses may have automated part of the process, while others are completed by hand.

Automating the entire AP process, however, can drastically reduce labor performed by staff and result in a more efficient process with reduced errors.

Productivity

With an AP software system, staff do not have to handle an invoice multiple times which can save time especially during a busy season.

You can reduce paper waste by going paperless since automation occurs online, and electronic payments speed up the process as well.

Over time, Accounts Payable software may provide a return on investment based on man-hours saved as well as better business intelligence provided by real-time reporting.

Benefits

Aggregated data is readily available for useful reporting, time saved can be spent on other tasks, and automation can reduce errors.

AP software provides an organized system with easy data access in order to streamline compliance and reporting during tax season.

A manual system may be inefficient. Outdated software may have limited functionality, unable to provide a complete accounting ERP solution.

Now may be the time to update your manual system or upgrade your outdated software in order to streamline your business and foster growth.

Passport Software

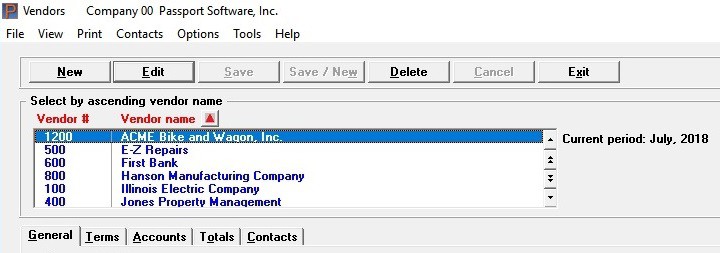

Passport Software’s Accounts Payable software for small business can help you keep accurate information on vendor and supplier and costs by tracking payment due dates, available discounts, and money owed to creditors, as well as help you manage your cash flow wisely.

Our AP module may be interfaced to Passport Business Solutions General Ledger, Job Cost and/or Purchase Order, Check Reconciliation, NCR Counterpoint or used stand-alone.

Call 800-969-7900 for more information. Or Contact Us – We are here to help.