AP Software for Your Small Business or Mid-sized Company

Hello again,

This post is for small to mid-sized companies who may be vetting a new accounting system. The following is sourced from levvel.io – We hope you find it useful.

Accounts Payable for the Small and Mid-Size Enterprise

“Introducing automated Accounts Payable (AP) is a simple yet effective way of driving down back-office costs.

Historically the tools needed to optimize and automate AP have been designed for the challenges and goals of larger enterprises, leaving small to mid-sized enterprises (or SMEs, defined as organizations between $1 million – $100 million in annual revenue) with limited options—often reducing them to patching together a series of disparate tools to address their problems.

Outcomes of these efforts vary, with most organizations settling for a tool that targets a specific pain point, such as reducing data entry labor.

Benefits

However, the true benefits of a fully optimized and automated AP system go far beyond more efficient data entry.

AP automation solutions offer tighter controls, streamlined approvals, strategic payments, and real-time access to transactional data, all of which allow finance professionals to make better and smarter decisions for their organization’s bottom line.

Today, automation technology has finally caught up to the specific needs of SMEs, so they no longer need to feel deprived of a more efficient and mature AP state.

Robust AP applications and platforms are now available with cost-reducing and control-enhancing features designed for the requirements of a mid-sized company.

Manual Entry

SMEs fall into a similar pattern with invoice data entry, mostly inputting data manually. Manual rekeying of invoice information (entering it into accounting systems from paper or digital formats) by AP clerks is time consuming and tedious, and results in more errors.

SMEs have mostly manual approval workflows, handing off paper to managers for approval or scanning and emailing individual invoices.

These companies can experience challenges around manual data entry and routing, as well as high rates of lost invoices.

Resources

Another challenge is stretched teams and resources. Small organizations are often pushed to do more with less. Once SMEs adopt AP automation technology, however, they experience significant improvements, especially in paper invoice volume reduction.

· Reduction in paper invoice volume

· Quicker approval of invoices

· Improved visibility into unpaid invoices

· Lower overall AP processing costs

· Increased employee productivity

· Reduction in late payment penalties and interest

· Increased capture of early discounts

· Better compliance with regulatory requirements

· Improved supplier relationships

Eliminating manual labor enables AP employees to process a much higher number of invoices per person, expediting processing times and reducing resources spent.

SMEs should begin their AP automation journey with a solution that allows them to immediately reduce paper invoice volume and automate data entry and invoice coding.”

Passport Software

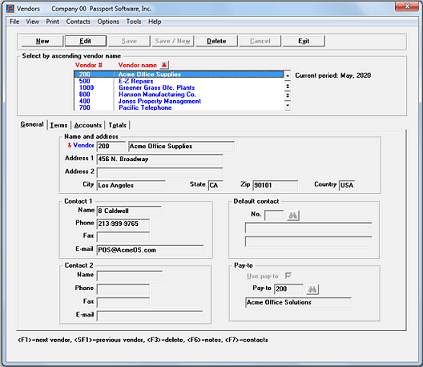

With 35 years of business and accounting experience, Passport Software provides comprehensive yet easy to use accounts payable software for small businesses and medium sized companies.

Simplify and integrate your accounting processes to better manage your company’s financial health. Comprehensive reporting provides business intelligence that can help you make better decisions and increase your bottom line.

Call 800-969-7900 – Or Contact Us. We are here to help.