Our ACA Software and Services Ease the Burden of Year-round Compliance

Tips for ACA in the “Off-season”

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

Busy company owners, administrative staff, and HR professionals are often tasked with the burdensome duty of year-round Affordable Care Act compliance management. Staying on top of changing regulations, tracking employee data accurately, and maintaining compliance throughout the year can be stressful and time-consuming.

Having an effective ACA compliance management process is crucial for avoiding costly penalties. Passport Software’s ACA software and services can help you simplify and comply throughout the year. Our friendly experts can answer any ACA-related questions you might have and walk you through the entire process.

Employee Classification

Affordable Care Act reporting season is behind us, but it’s crucial to avoid compliance errors year-round, including the summer months.

Accurately tracking employee hours for seasonal workers may become more complicated when there is an uptick in summer employment. For instance, some restaurants and hotels may employ more staff in the summer months. During the holidays, the retail sector often sees an uptick in seasonal workers.

“Seasonal employment is appropriate when the work recurs predictably year-to-year and is expected to last at least 6 months during a calendar year. The season must be defined as closely as possible so that an employee will have a reasonably clear idea of how much work can be expected,” according to the IRS.

Seasonal workers are not full-time, but the count is relevant for determining whether an employer is an ALE subject to the employer shared responsibility provisions.

Accuracy

Accurate tracking of employee status and classification is crucial for avoiding Affordable Care Act penalties. Manual tracking may be error-prone, especially if your company employs seasonal or temporary workers and many employees have fluctuating hours. Also, manual tracking of ACA-related data can be complex if your company has more than one location.

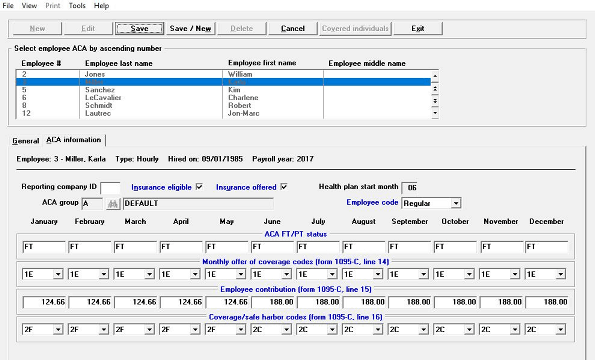

Passport Software’s ACA software and services can help you streamline employee data management to avoid penalties year-round. Our IRS-certified software alerts when a part-time employee is trending towards full-time, when offers of coverage are needed and if coverage is considered affordable under IRS criteria.

It’s crucial to document ACA-related data accurately. Accurate data is needed to determine when offers of coverage are required and ensure they are affordable under IRS criteria. And, the IRS will request the appropriate documentation if you are audited, including proof of full-time calculations.

Passport Software

A comprehensive Affordable Care Act software solution provides much more than just forms for reporting. Our IRS-certified ACA software and services help you simplify and comply year-round. We can answer any ACA-related questions you may have and help with late and past years’ filing.

With ACA Full Service, we do it all for you year-round, including filing. We also provide penalty response consultation services and have helped many companies avoid or drastically reduce penalties.

Our ACA customers often tell us we are so much easier and more affordable than their prior solutions.

To learn more about how our ACA software and services can ease the burden of compliance, call 800-969-7900. Or, contact us – we are here to help.