An IRS-to-English Translation of IRS 1095-C Codes for the Affordable Care Act

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. The following was written by Adam Miller, Passport Software’s ACA Specialist and HR Compliance Manager. We hope you find it useful.

Three Key Requirements

The information below is a simplified orientation to the various IRS 1095-C Codes designed to make things more understandable. Please note, however, that there are nuances which should be reviewed in the IRS 1095-C instructions or by an Affordable Care Act professional before action is taken.

Prior to a review of the code translations, there are three key requirements to be met in order to comply with ACA standards. Collectively, these are often referred to as Bronze level plans. They are:

1. Minimal Essential Coverage (or MEC) satisfies the Individual Mandate of the ACA.

2. Minimum Value (MV) generally means it has 60% actuarial value (covers 60% of average medical costs), which satisfies the employer-sponsored requirement of the ACA.

3. To be considered affordable in 2022, the employee’s share of the cheapest MEC/MV, self-only plan must be less than 9.61% of their income (dropping to 9.12% for 2023). The employer may estimate income using one of 3 methods. Note that it is not necessarily what the employee is paying, but what they could have paid.

Passport Software’s IRS-certified ACA software helps ensure year-round compliance and provides automated 1094/1095 filing. Our ACA software alerts when offers of coverage are needed and if the coverage is considered affordable based on IRS criteria.

The Series 1 Codes

For our purposes in the descriptions below, we’ll use the shorthand abbreviations, MEC and MV.

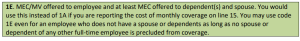

Series 1 Codes. 1095-C line 14 (The most common codes are in highlighted in green)

1A. Qualifying Offer. This describes an MEC/MV offer to the employee and at least MEC offered to a spouse and any dependent(s).

When using code 1A, the employer does not complete Line 15 (Employee Contribution Amount) on each

employee’s 1095-C. Instead, they must certify that the contribution is less than the Federal Poverty Level

affordability calculation ($108.83 for 2022). Finally, the ALE must check the box for Qualifying Offer Method on Line 22 of the 1094-C.

1B. MEC/MV offered to employee only.

1C. MEC/MV offered to employee and at least MEC offered to dependent(s), but not spouse.

1D. MEC/MV offered to employee and at least MEC offered to spouse but not dependent(s).

1F. MEC not providing MV, offered to employee or any combination of spouse or dependents.

1G. Offer of coverage to employee who was not a full-time employee for any month of the calendar year and who enrolled in self-insured coverage for one or more months of the calendar year.

1I. Only used in 2015.

1J. MEC/MV offered to spouse and MEC conditionally offered to the spouse. Not offered to dependents

1K. MEC/MV offered to spouse and MEC offered to dependents. MEC conditionally offered to the spouse.

1L. HRA coverage offered to employee only. Line 17 will reference their residential ZIP code.

1M. HRA coverage offered to employee and dependents (not spouse), Line 17 will reference their residential ZIP code.

1N. HRA coverage offered to employee, spouse, and dependents. Line 17 will reference their residential ZIP code.

1O. HRA coverage offered to employee only. Line 17 will reference their primary employment site ZIP code.

1P. HRA coverage offered to employee and dependents (not spouse). Line 17 will reference their primary

employment site ZIP code.

1Q. HRA coverage offered to employee, spouse, and dependents. Line 17 will reference their primary

employment site ZIP code.

1R. HRA coverage that is not affordable offered the employee and any combination of spouse and dependents.

1S. HRA coverage offered to non-full-time employee.

1T. HRA coverage offered to employee and spouse without dependents. Line 17 will reference their residential ZIP code.

1U. HRA coverage offered to employee and spouse without dependents. Line 17 will reference their primary employment site ZIP code.

Passport Software’s comprehensive ACA software is easy to use and provides a dashboard that resembles the 1095-C. When you do default/mass update/manually change these codes, our ACA software automatically pairs the corresponding Zip Code (from the company address or home address for each employee), but you can also override the Zip Code if necessary.

The Series 2 Codes

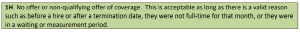

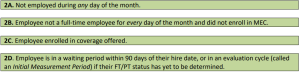

Series 2 Codes. 1095-C Line 16 (The most common codes are in green)

2E. Multi-employer interim rule relief. Enter code 2E for any month for which the multi-employer interim guidance applies for that employee.

Note: An employer may not use different 2F/2G/2H safe harbor codes for the same employee in the same calendar year.

2I. Reserved for future use.

A blank Series 2 Code is a technically valid option, but another Line 16 code should always apply.

Passport Software’s ACA software streamlines ACA data management to help reduce tracking errors, and our annual update program updates the software to accommodate new fields or codes required for correct filing.

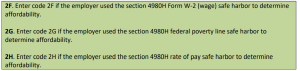

Valid Code Combinations

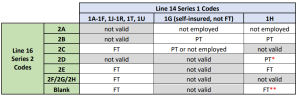

The following chart will tell you if a combination of a 1095-C Line 14 (horizontal axis) and Line 16 (vertical axis) codes is valid. If so, it will tell you whether it applies to full-time or part-time employees.

* For the purposes of calculating the 95% compliance 4980H(a) penalty, the IRS does not consider a new hire in their (up to) 90-day waiting period to be full-time.

** Code 1H combined with leaving Line 16 blank may result in a penalty. Valid reasons for not offering coverage and which should not result in a penalty are:

• 2A. Not employed that month

• 2B. Not FT for every day of that month

• 2D. In a waiting or measurement period

• 2E. Part of a multi-employer arrangement

We hope this information will be useful. For human resource managers newly tasked with ACA compliance management, gaining an understanding of the basic concepts can be a helpful step. For seasoned filers, having an easy-to-understand explanation of the basic codes can help with responding to employee and employer questions about ACA compliance reports.

Our ACA software simplifies the entire compliance process, and we are IRS-approved for optional proxy submission on behalf of our clients. ACA Full Service is the easiest option – just provide a spreadsheet with employee data, and we do the rest, including filing.

To learn more about how our ACA software and services can help ease the burden of compliance and for pricing, call 800-969-7900. Or, contact us – we are here to help.