IRS to English Translation of Affordable Care Act 1095-C codes

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

The 1095-C evolves each year, with small changes from the IRS. The information below has been simplified and designed to make things more understandable, but there are nuances in the IRS’s 1095-C instructions which should be reviewed by an Affordable Care Act professional.

In this first of a three-part series, we’ll review the Series 1 Codes.

ACA Compliance Prerequisites

Before we address the code translations, it’s important that we understand that there are three key requirements to meet ACA standards. Collectively, these are often referred to as Bronze level plans.

1. Minimal Essential Coverage (or MEC) satisfies the Individual Mandate of the ACA.

2. Minimum Value (MV) generally means it has 60% actuarial value (covers 60% of average medical costs), which satisfies the employer-sponsored requirement of the ACA.

3. To be considered Affordable, the employee’s share of the cheapest MEC/MV, self-only plan must be less than 9.83% (adjusted for 2021) of their income. The employer may estimate income using one of 3 methods. Note that is not necessarily what the employee is paying, but what they could have paid.

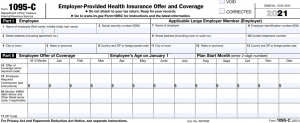

For our purposes in the descriptions below, we’ll use the shorthand abbreviations, MEC and MV. For reference, here is an image of the 1095-C form:

Series 1 Codes. 1095-C line 14

[The most common codes are in green].

1A. Qualifying Offer. This describes an MV offer to the employee and at least MEC offered to a spouse and any dependent(s).

When using code 1A, the employer does not complete Line 15 (Employee Contribution Amount) of each employee’s 1095-C. Instead, they must certify that the contribution is less than the Federal Poverty Level affordability calculation ($105.50 for 2021). Finally, the ALE must check the box for Qualifying Offer Method on Line 22 of the 1094-C.

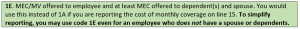

1B. MEC/MV offered to employee only.

1C. MEC/MV offered to employee and at least MEC offered to dependent(s) but not spouse.

1D. MEC/MV offered to employee and at least MEC offered to spouse but not dependent(s).

1F. MEC not providing MV, offered to employee or any combination of spouse or dependents.

1G. Offer of coverage to employee who was not a full-time employee for any month of the calendar year and who enrolled in self-insured coverage for one or more months of the calendar year.

1I. Only used in 2015.

1J. MEC/MV offered to employee and MEC conditionally offered to the spouse. Not offered to dependents.

1K. MEC/MV offered to employee and MEC offered to dependents. MEC conditionally offered to the spouse.

1L. ICHRA (Individual Coverage Health Reimbursement Arrangement) coverage offered to employee only. Line 17 will reference their residential ZIP code.

1M. ICHRA coverage offered to employee and dependents (not spouse), Line 17 will reference their residential ZIP code.

1N. ICHRA coverage offered to employee, spouse, and dependents. Line 17 will reference their residential ZIP code.

1O. ICHRA coverage offered to employee only. Line 17 will reference their primary employment site ZIP code.

1P. ICHRA coverage offered to employee and dependents (not spouse). Line 17 will reference their primary employment site ZIP code.

1Q. ICHRA coverage offered to employee, spouse, and dependents. Line 17 will reference their primary employment site ZIP code.

1R. ICHRA coverage that is not affordable offered the employee and any combination of spouse and dependents.

1S. ICHRA coverage offered to non full-time employee.

1T. ICHRA coverage offered to employee and spouse without dependents. Line 17 will reference their residential ZIP code.

1U. ICHRA coverage offered to employee and spouse without dependents. Line 17 will reference their primary employment site ZIP code.

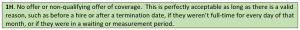

Though the codes can seem overwhelming, half of them apply only to ICHRA plan employers. In practice, the vast majority of cases should only use two codes—1H (no offer) or 1E (offered qualifying coverage to the employee and their immediate family).

We hope this informal review helps make ACA year-end work go more smoothly.

ACA Software and Services

ACA software products that can be used to simply to file ACA reports are not uncommon. Expertise and personalized service in the management of ACA compliance all year long is less common.

Companies are facing a variety of circumstances in these times. Impactful disruption or unplanned expansion makes grappling with staff hours, offers of insurance and tracking all the data needed to correctly comply with ACA particularly challenging.

Comprehensive ACA software can streamline data management year-round. And, consulting with an ACA expert to address unique or confusing circumstances can help avoid mistakes that could result in penalties.

Sometimes just a phone call resolves the problem. Some circumstances, such as IRS penalty letters, require a more comprehensive approach.

Passport Software

Our aim is to help your company avoid issues by maintaining compliance. Our ACA software has a variety of reports that give you insight and help prompt needed actions.

In addition to our ACA software or our ACA Full Service option, we provide penalty response consultation and can answer questions about the ACA in general.

Our seven years of experience with ACA consulting and support can help your company deal with the unique and individual circumstances that don’t fit into a simple reporting solution.

Whether your company has chosen to “Pay to Play” or to provide offers of affordable coverage, we work as your ACA Partner to provide our ACA expertise throughout the year to help you avoid unnecessary penalties.

Our US-based support is friendly and knowledgeable. We are IRS-approved to file with the IRS on our clients’ behalf and our ACA software is IRS-certified so you can have confidence in our products and services.

In our next article we’ll continue with the Series 2 Codes. 1095-C Line 16.

Learn more about how our IRS-approved ACA software can help you monitor compliance throughout the year in order to help prevent penalties. Or, contact us – we are here to help.