Our ACA Software and Services Simplify Compliance and Reporting

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

The following is transcribed from a helpful ACA Compliance Webinar presented by Adam Miller, Passport Software’s HR Compliance Manager and ACA Specialist.

Overview of Our ACA Software

Passport Software has provided IRS-certified ACA Software since 2015, the first year of the Affordable Care Act. Due to many requests to handle the transmission of the electronic files, or the entire administrative aspect, we added those service options for 2016.

Our ACA Software requires a one-time software licensing fee. Annual renewals are extremely reasonable and ensure that software is always compliant with changes to the ACA, as well as our own enhancements to make your life easier.

We also provide Full-Service ACA – just provide a spreadsheet with employee data, and we do the rest.

Easy to Use

Passport Software’s ACA Software is the most user friendly, comprehensive option available. We make it easy to bring in employee information from any payroll system which can generate a text file or spreadsheet, and you only need about 15 pieces of information per employee.

We’ve seen absurd 200 column spreadsheets from competitors and instead, we give you tools to generate and maintain ACA codes and information much more efficiently.

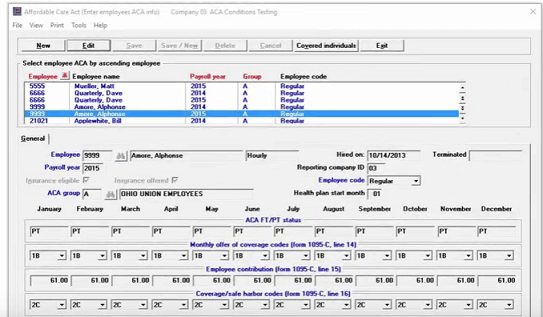

If you have any experience with the 1095-C forms, the primary maintenance screen of our software will be very familiar, only better, because you can change an entire row of data with just 1 mouse-click and 1 keystroke.

You can also change these codes and contribution amounts for all, or some portion of your employees in a single mass update.

A good ACA Software solution will print all the employee copies of the 1095-C in addition to the IRS forms. Of course, Passport Software does that and more, from analysis and maintenance reports, to generating Transmitter Control Code test files, to interfacing with the IRS’s TIN Matching database.

We handle self-insured clients, and consolidated reporting for multiple EIN common ownership groups.

And finally, most clients opt for the electronic filing, because they have over 250 full-time employees, multiple EINs, or because it’s just plain easier (at least once you have your TCC).

Our ACA Software is easy to read and easy to use. Here’s a sneak peek of one screen, and you can notice the resemblance to the 1095-C.

Full-Service Option

We have received many requests to save people from having to handle their ACA needs in-house. Passport Software has a Full-Service option where we import and maintain the clients data to a secure server, provide optional part-time monitoring and management if required, screen the data for potential errors, print and mail Employee 1095-Cs to the employer, and electronically file on the client’s behalf, with IRS confirmation.

We provide HIPAA agreements, and again, our services are IRS certified and approved.

There is an almost universal renewal rate among clients, and we handle clients ranging from the barely above the 50 employee threshold, to American divisions of an international automaker and everything in between.

To learn more Contact Us or call 800-969-7900.