ACA Compliance – Filing Deadlines for the 2018 Tax Year

ACA 1094-C and 1095-C Deadlines

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it helpful.

The following is sourced from the ACA Times:

“The IRS has released Revenue Procedure 2018-57, which highlights the penalty rates associated with failing to provide ACA information by IRS deadlines for the 2019 tax year, such as failing to distribute 1095-C schedules to your workforce.

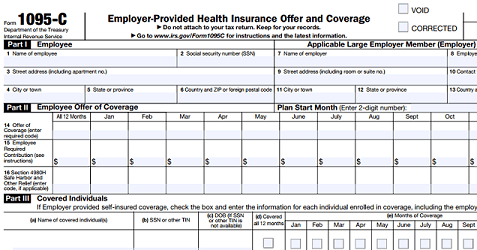

That means having your forms 1094-C and 1095-C ready by February 2019 for distribution to employees and for filing with the IRS.

The IRS recently issued an extension for furnishing forms 1094-C and 1095-C to employees for the 2018 tax year, which extends the schedule employers need to keep in mind to comply with the ACA. The updated schedule is as follows:

· Paper file 1094-C/1095-C schedules with the IRS no later than February 28, 2019

· Furnish 1095-C schedules to your workforce no later than March 4, 2019 (original deadline was January 31, 2019)

· Electronically file 1094-C/1095-C schedules with the IRS no later than April 1, 2019

Failing to meet these deadlines can result in penalties under IRC 6721/6722.”

Make sure to furnish correct payee statements and file correct information returns as well to avoid penalties.

For questions about ACA compliance in general, or to learn more about our ACA Software and Services call 800-969-7900.

Or Contact Us – We are here to help ease the burden of Affordable Care Act compliance and reporting.