ACA Update: 2019 Tax Year Filing

Hello again,

The following is sourced from a webinar presented by Adam Miller, our HR Compliance Manager – we hope this information helps you with your 2019 Affordable Care Act management and filing.

2019 Changes

You may have heard about the efforts to repeal and replace the ACA, court challenges, or the elimination of the Individual Mandate tax penalty, but from the employer’s side, there have been no significant 2019 changes to the law or its enforcement, only inflation-related adjustments to the penalties and affordability percentage.

Individual

· No more tax penalty for not being insured

Businesses

· Shared Responsibility “B” Penalty increases to $3,750 per year

· The “A” penalty is expected to increase to $2,500 per year

· The Federal Poverty Level increases from $12,060 to $12,140 per year

· Affordability standard increases to 9.86% of the employee’s income

Who is Full-time?

For many employers, their toughest part comes from trying to decide who is full-time. The short answer is “anyone who averages 130 or more hours of paid service per month,” but the catch is that every new employee has their own rule, based around their hire date.

IRS definition:

· Anyone hired with the reasonable expectation of working full-time

· A previously part-time employee, officially promoted to a full-time position

· A variable hour hire who averaged 130+ hrs/month using the Look Back Method

· New employees have their own unique periods of measurement

Passport’s Affordable Care Act Management Software™ provides these Look Back-styled reports configured to your company’s requirements.

Tracking Offers of Coverage

You’ve identified your full-time employees and made offers to them, and, in addition to the “ground rules” about what coverage qualifies, you need to manage the information that you’ll be reporting to the IRS early next year.

This includes dates, codes, and employee contribution amounts. Remember that the 1095-C contribution amount is not necessarily the same, and is often less than the plan an employee actually chooses for enrollment.

Standards

· Must provide Minimum Essential Coverage

· Must meet the Minimum Value standard

· Affordability—for 2019, less than 9.86% of the employee’s household income

1095-C reporting

· Record who (employee/spouse/dependents) was offered coverage, with dates

· Record “could have” contribution amounts, not actual premiums

ACA reporting is concerned with what the employee could have paid, rather than the real world deduction.

Passport Software’s ACA Solution

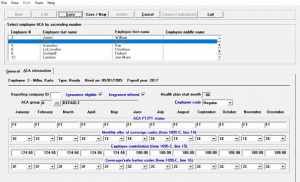

We’re very proud of our ACA solution, and below is a sneak peak of an employee’s information record in our software. We use the same codes as the IRS, but we give you easy tools to import, generate, and edit the information—individually, or in mass, which you can see here.

Employee Information Screen

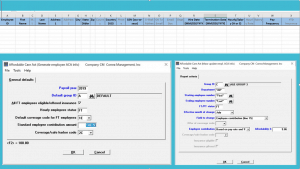

Excel Template for Employee Information, ACA Record Generator, Mass Update Utility

On top is our simple Excel template for basic employee information (only 13 of the 24 columns are required). The bottom left is our ACA record generator, which also leverages information like employment dates to intelligently pre-populate individual records. And on the right side is our Mass Update utility.

Whether your entire company or just a department needs to be updated, this powerful tool will let you change codes or contribution amounts for any group or department, for any months of the year.

And with all of our software packages, we provide an interactive user manual to explain what everything means. Of course, we also offer top-rated ACA Support and Consultation by phone or email.

2019 Tax Year Filing

It’s January 2020 and you’ve been maintaining your 2019 records meticulously. You’re ready to file. No extensions are expected this year, and if you have 250 or more forms, you’ll be required to file electronically.

If you are an electronic filer, you need to apply for your Transmitter Control Code (or TCC) early—there are several stages and it can take up to 6 weeks if you aren’t already registered with IRS E-Services.

But don’t fear—we have a detailed document to help you apply, and our software produces the test files required for your TCC approval.

Prepare for tax year 2019 Filing:

Employee copies

· Approved forms (portrait or landscape) must be distributed by 1/31/2020

IRS paper filing

· Pre-printed forms must be landscape only and are due by 2/28/2020

IRS electronic filing

· Mandatory if 250 or more forms and must be transmitted by 3/31/2020

· Requires a Transmitter Control Code (TCC) or a service to transmit for you

Passport can also transmit on your behalf to save you the IRS-induced headaches. We even offer services where you simply provide the data and we do everything else.

We hope this information is useful. If you have questions about our ACA software or services call 800-969-7900.