ACA Software Streamlines ACA Compliance Processes

Our ACA Software Alerts When Offers of Coverage Are Needed

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

If you are tasked with managing Affordable Care Act compliance for your company, you may find year-round data management to be complex or even burdensome.

HR professionals, administrators, or others tasked with ACA compliance management play a crucial role in avoiding potentially costly ACA penalties. This important duty can have a burdensome impact if you find managing ACA-related data to be difficult or overwhelming.

It’s important to stay on top of all aspects of ACA compliance management in order to prevent errors and avoid penalties. Being aware of changes related to the ACA can help you keep an eye on compliance management challenges that might occur. A recent ACA-related change to be aware of is the eligibility expansion of the Premium Tax Credit.

The ACA Premium Tax Credit

The Premium Tax Credit helps qualifying individuals obtain more affordable health coverage under the ACA. The 2021 American Rescue Plan has expanded PTC eligibility, thereby increasing the incentive for people in certain income brackets to obtain coverage through a state or federal health exchange.

Due to expanded PTC eligibility, more employees may decline coverage offered by an employer and purchase it through a health exchange.

PTC applications are used by the IRS to help identify employer non-compliance with the ACA. It’s important to make appropriate offers of coverage on time and ensure the offers are affordable under IRS criteria, and the burden of proof is on the employer if audited by the IRS.

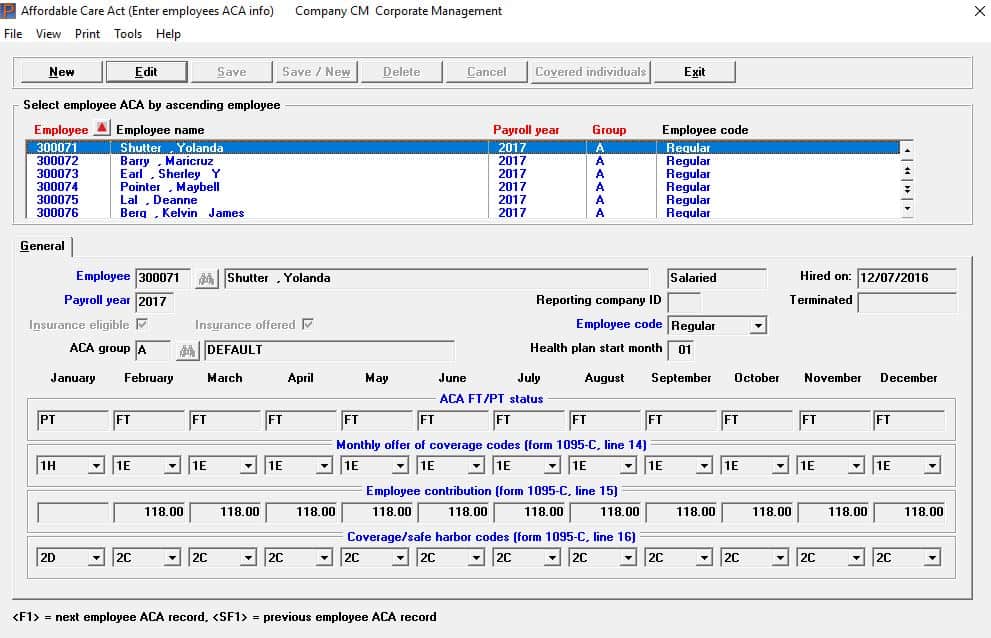

Our IRS-certified ACA Software provides reports indicating when offers of coverage are needed and if those offers are considered affordable under IRS criteria. Comprehensive ACA software allows you to track and manage data year-round to help avoid costly penalties.

According to Irs.gov, “The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace. To get this credit, you must meet certain requirements and file a tax return with Form 8962, Premium Tax Credit (PTC).

2021 and 2022 PTC Eligibility. For tax years 2021 and 2022, the American Rescue Plan Act of 2021 (ARPA) temporarily expanded eligibility for the premium tax credit by eliminating the rule that a taxpayer with household income above 400% of the federal poverty line cannot qualify for a premium tax credit.”

Expanded PTC eligibility ends after 2022, but the current administration has communicated its desire to extend or make the expansion permanent.

ACA Non-compliance

The IRS can cross-reference a PTC application with an employee’s 1095-C to identify and determine if an employee was offered appropriate health coverage by an employer. The employer must provide documentation of offers of coverage if the IRS claims the employer did not offer appropriate coverage.

Our IRS-certified ACA software can help you manage your data effectively throughout the year in order to help ensure appropriate offers of coverage are timely and considered affordable under IRS criteria. We are also IRS-certified for proxy submission on behalf of our ACA software customers.

If your ACA data management is inaccurate then you may be at risk for lapses in offering appropriate coverage, which can lead to steep penalties.

Passport Software’s ACA software streamlines data management to help ensure compliance with the ACA. By reviewing status alerts about when offers of coverage are needed, you can ensure you are making the offers on time. If you are manually tracking or are overwhelmed with complex ACA-related data, our ACA software can simplify the compliance management process to reduce penalty risk.

If you are overwhelmed, our ACA software and services can help.

Passport Software

Since 2015, we have partnered with our ACA customers to help them stay on track and remain compliant. If you are overwhelmed or doing most of the work on behalf of your payroll provider, our ACA software can streamline compliance management.

We have a proven track record for helping prevent penalties, and our penalty response consultation services have helped many companies avoid or drastically reduce penalties.

Our friendly customer support can help if you are struggling with compliance management or need answers to ACA-related questions. We can help you meet the ongoing challenges of compliance with our ACA software or ACA Full Service – just provide a spreadsheet and we do the rest including filing.

Passport Software’s ACA software and services are affordable and easy-to-use, and we provide excellent training and support.

To learn more call 800-969-7900. Or, contact us – we are here to help.