Our ACA Software and Services Can Alleviate the Burden of Compliance

ACA Compliance Challenges

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

If you are an HR professional or administrator you are likely very busy with important duties that make the company function smoothly. You may be handling extra duties which have been thrown at you by The Great Resignation and the pandemic, such as dealing with staffing challenges.

On top of an already busy schedule, you may also be tasked with compliance management, where accuracy is crucial in order to avoid fines and penalties.

Among the most challenging compliance management duties can be ACA compliance, depending on your company, and penalties can be steep.

The ACA paper filing deadline was Feb. 28th, 2022, and the deadline for furnishing statements to employees was March 2, 2022. The deadline for electronic filing is March 31, 2022.

If you are running behind on your ACA preparation work or are overwhelmed by ACA compliance management, we can help. Our ACA software and services can help you save time and free you up for other critical duties.

ACA Filing

Form 1094-C is used for the cover sheet when filing, and fields include the ALE’s physical address, phone number, contact person, Employer Identification Number (EIN), and total number of 1095-C forms being filed.

Form 1095-C provides employee information including name, address, SSN, birthdate, and information about any coverage provided. This includes applicable safe harbors, offers of coverage, and employee monthly contribution amount.

Whether you paper file or electronic file, our ACA software can help you streamline compliance year-round. Our ACA compliance software provides an easy-to-use interface that closely resembles the 1095-C and allows you to easily manage employee data throughout the year.

Paper filing this year may have been affected by slowdowns with the US mail. The possibility of delays may be an issue, and your filing documents could show up late, causing a late filing penalty. Even worse, your documents may be lost in the mail.

If you haven’t paper filed yet, you may want to elect to file electronically. Electronic filing provides verification when you complete the filing process and will alert you to filing errors.

The March 31st electronic filing deadline provides extra time for preparation and provides a receipt ID when you file which validates the date you filed.

Electronic filing is required for companies that file 250+ forms. The IRS has proposed regulations that could lower the electronic filing requirement threshold to 10+ forms after 2022.

ACA Penalties

According to the ACA Times, “As of December 2021, the IRS identified 5 million letters of taxpayer correspondence in its current backlog. And because the IRS personnel reassignment is slated to run through fall 2022, employers should keep an eye out for notices for the rest of the year.”

There is no statute of limitations for ACA penalties, so companies may receive IRS letters from prior years: Letter 5699, Letter 226J, Letter 5005-A, Letter 972CG.

– Letter 5699 requests a company’s reason for not filing Forms 1094-C and 1095-C in previous years.

– Letter 5005-A is a penalty notification that follows Letter 5699.

– Letter 972CG is sent to employers for late ACA filings.

– Letter 226J (4980H B Penalties) notifies an Applicable Large Employer that they may be liable for an Employer Shared Responsibility Payment (ESRP).

Our ACA reporting services include penalty response consultation and we’ve helped many companies avoid or drastically reduce penalties.

Passport Software’s ACA Software

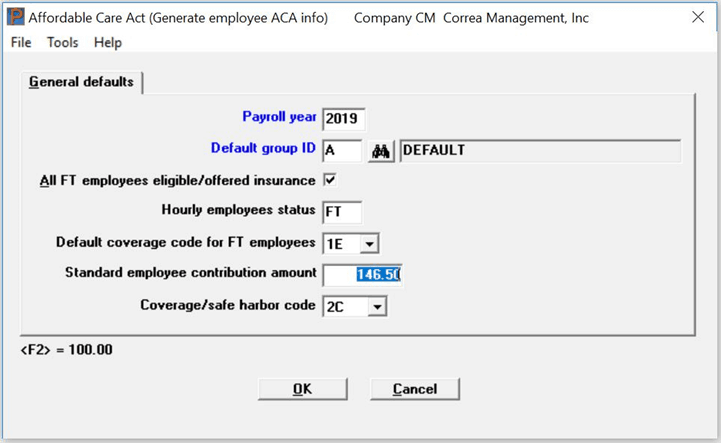

Comprehensive ACA tracking software has many benefits, including the ability to manage ACA-related data year-round. Automation allows you to easily update your 1094-C and 1095-C form information for data accuracy. You can also streamline filing by doing so electronically, and our IRS-certified ACA software provides electronic submission.

We are IRS-approved for optional proxy submission for our software users and can help with social security validation and filing corrections.

It’s important to determine if the healthcare coverage offered to qualifying employees is affordable. And, the affordability threshold changes every year. Failing to meet the affordability criteria may result in 4980H(b) penalties up to $4,120 per employee (annualized) for the 2022 reporting year. The IRS has established three types of safe harbors that are used to establish monthly contribution amounts for employees.

Our ACA software provides reports that identify when an offer of coverage will be needed and whether coverage meets affordability standards. It also provides other reports including the ALE Calculation, Insurance Eligible & Offered, the Initial Measurement Period, the Standard Measurement Period, and the Safe Harbor Comparison reports.

Passport Software’s ACA software solution streamlines data management, is easy to use, and provides much more than just forms:

– Easily manage employee profiles

– View average hours worked per month

– Assess when part-time employees are trending towards full-time

– Determine eligibility in order to make appropriate offers of coverage

– Assess whether offers of coverage are considered affordable under IRS criteria

– Potentially reduce errors if you’re manually tracking ACA-related data

If you are underwhelmed by your current ACA solution, our affordable ACA software and services can help ease the burden of compliance. Automation can help you save time and potentially reduce errors if you are manually tracking.

To learn more about our ACA software and services call 800-969-7900. Or, contact us – we are here to help.