ACA Software and Services Help HR Professionals Streamline Compliance

Ease the Burden of ACA Compliance

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

HR professionals handle numerous responsibilities throughout the year. Additionally, due to the pandemic, you may be handling additional responsibilities such as staffing issue challenges or helping employees get set up for remote work.

As year-end approaches, HR staff may be tasked with many duties to ensure compliance with various compliance regulations.

Numerous Responsibilities

Year-end may tend to generate an overwhelming to-do list of duties that need to be completed in a timely manner by HR professionals.

HRdoorway.com explains the details regarding year-end preparations for documents required for tax filings that may include:

– CARES Act retention credit

– FFCRA tax credit

– FICA & FUTA forms

– IRS Payroll Tax Holiday

Other year-end responsibilities for HR professionals may include reviewing and refreshing benefits packages, reviewing insurance coverage plans and pricing, and setting up FSA plans.

Issuing end-of-year bonuses, handling wage increases, and managing hiring/training may also be on your plate.

Other duties may include reviewing employee time-off, issuing reminders if vacation days expire at year-end, or updating the employee handbook. Or, verifying employee information such as addresses to ensure prompt delivery of W-2 forms to double checking W2-s for correct SSN information.

ACA Software and Services

In addition to these many responsibilities, HR staff may be tasked with managing ACA compliance if their company is an Applicable Large Employer (50+ full-time or full-time equivalents).

ACA requirements can be complex to navigate, and year-round management is crucial for companies required to maintain compliance. ALEs must offer qualifying and affordable medical coverage (under IRS criteria) to full-time employees and their dependents or risk potentially steep penalties.

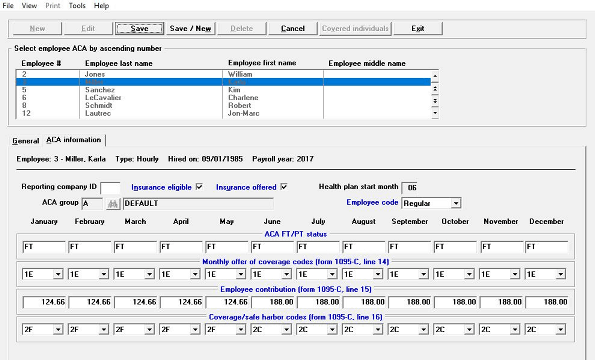

Utilizing comprehensive ACA software or an ACA Reporting Service can help ease the burden managing ACA-related data throughout the year.

Keeping up with ACA data management can become overwhelming, yet accurate tracking and monitoring the required offers of coverage and affordability is crucial.

If you are manually tracking and struggling with ACA data management, a comprehensive ACA software solution can help streamline compliance.

Designated Individual

In some cases, multiple individuals are responsible for data tracking and compliance management. Having a designated employee to track and manage ACA related data throughout the year can help avoid errors due to miscommunications.

If you are manually tracking or using forms-only software, comprehensive ACA software can help aggregate and streamline data to help prevent errors.

An effective ACA software solution can help reduce the risk of penalties by providing alerts when offers of coverage are needed. And, having a designated employee trained to use the ACA software can free up other employees for other important duties.

You can also effectively outsource the ACA compliance process using a Full Service option with proven track record of expertise and excellent customer service.

Many ACA software vendors offer a forms-only solution, and you are doing most of the compliance management year-round.

Or, your vendor may not provide great customer support or be affordable. Having a reliable ACA Full Service provider or using comprehensive ACA software with excellent support can make the process more efficient.

Expert ACA compliance support can also help reduce the risk of penalties and free up HR professionals for other important HR duties.

With the right compliance management tools, such as comprehensive ACA software, it’s possible to streamline the numerous compliance-related tasks you may have at hand. Instead of feeling overwhelmed, you can implement an effective system of tracking and data management.

With the right ACA software or Reporting Service and great ACA support, you can rest assured that your ACA-related data is being appropriately managed.

Time for the “People” side of HR

Maintaining compliance is an important priority but caring for employee morale and performance is vital as well. Having a comprehensive ACA software solution and ACA compliance support can free up HR personnel for the “people” side of HR.

Site visits, individual conversations, annual reviews all add up to staying in touch with employees and letting them know they are valued. When HR staff can’t be available to employees, minor issues can escalate, preventable problems can go unaddressed and the company may lose important talent.

Automating as much work of compliance as possible supports efficient and accurate year-end reporting, but it also supports a healthy work environment for all employees by allowing HR staff to care for the “people” side of the business.

Early On

When the Affordable Care Act was first enacted, many companies were uncertain about how stringently compliance would be enforced. Others expected that it would go away, and still others weren’t clear on who the ACA regulations applied to.

No matter what the reasoning was, many companies who chose not to file in the past are finding out now that they have been identified by the IRS as potentially being in violation.

At risk of having to pay substantial penalties, companies in these circumstances would be wise to seek expert consultation. HR staff are not generally equipped to manage IRS compliance for past years.

Passport Software

Our IRS-certified ACA Software or Full Service option can help you streamline compliance and reduce the risk of penalties. We are IRS-approved for optional proxy filing, and we also provide penalty relief consultation service.

Knowing where to turn for help with ACA compliance management can make all the difference. Our expert consultants are friendly and can walk you through the entire compliance process.

Our ACA Software is affordable and easy to use and provides much more than just forms. ACA Full Service is the easiest option – just provide a spreadsheet with employee data, and we do the rest.

We also provide penalty response consultation and have helped many companies avoid, or drastically reduce penalties.

Learn more about how our IRS-approved ACA software can help you monitor compliance throughout the year in order to help prevent penalties. Or, contact us – we are here to help.