Our ACA Software and Services Simplify Compliance

ACA Compliance is Now More Crucial than Ever

In April President Biden requested discretionary funding from Congress for 2022, and this request includes funding that will enable the IRS to “increase oversight of high-income and corporate tax returns to ensure compliance…”

This includes enforcement of ACA compliance for ALEs.

The fiscal measure is set to provide a $417 million increase in tax enforcement funding. Increased resources for enforcing ACA compliance make it crucial for ALEs to protect themselves from penalties.

Enforcement

According to the ACA Times, “That means the IRS will have more resources for assessing employers’ non-compliance with tax requirements, like the ACA’s Employer Mandate…the IRS has been consistent in increasing its enforcement efforts of the ACA.

The agency clarified that 2020 would be the final extension of Good-Faith Relief for reporting and furnishing under Sections 6055 and 6056.

The IRS General Counsel also clarified that there is no statute of limitations for Employer Shared Responsibility Payment (ESRP) penalties.

That means moving forward, there should be an increase in the amount in penalty assessments via Letter 226J and in the volume of penalties being issued.

The IRS is currently issuing Letter 226J penalty notices for the 2018 tax year.”

In addition, “The IRS made it known that employers that fail to pay ACA penalties could have their property levied and or liened against them.

An IRS levy permits the legal seizure of property to satisfy a tax debt. The agency can take money in financial accounts, seize and sell your vehicle(s), real estate, and other personal property.

If your organization is owed a tax refund [there have been] situations where the agency offset the ESRPs with a tax overpayment.”

Penalty Relief

If you receive an ACA penalty notification from the IRS, it’s useful to seek professional advice from an ACA compliance expert.

Our ACA compliance specialist can help, and we’ve helped many companies drastically reduce or avoid penalties altogether.

You may be a very busy HR compliance manager, and the pressure of remaining compliant may rest on your shoulders.

If you are concerned about receiving an ACA penalty notification, we can help you understand and initiate the needed steps for effectively dealing with the notification.

Solutions

If you are overwhelmed with maintaining ACA compliance, we can help. Perhaps your solution provides forms filing only, or you are doing most of the work and the solution is costly.

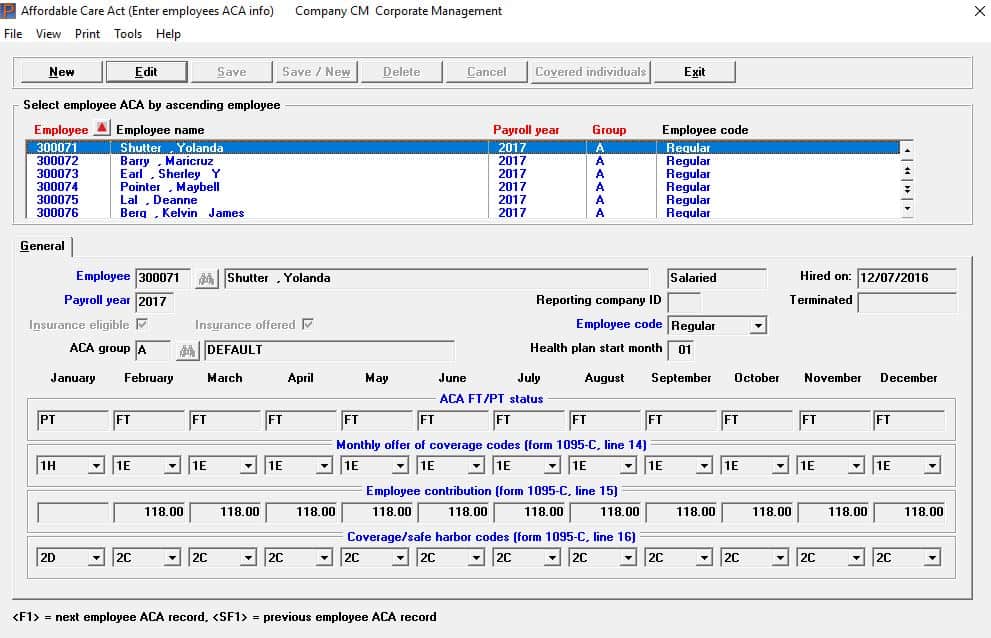

Passport Software’s ACA solutions are easy-to-use, affordable, and our customer support is excellent. Also, we are IRS-certified for optional proxy submission.

Our IRS-certified ACA Software can help you track and manage compliance year-round. Or, with our ACA Full Service option, you can turn the entire process over to us. Just provide a spreadsheet with employee data, and we do the rest.

ACA Compliance Overwhelm

Payroll services generally offer ACA-related reporting at a per employee rate. While there is some reduction in work load in exchange for the cost, much of the data gathering and assembling responsibilities still rest with in-house staff.

Liability and penalties usually fall to the employer as opposed the service. The cost/benefit ratio needs to be reviewed closely to see if this a good choice.

Is your payroll provider’s ACA service expensive, requiring you to do most of the work? Are you constantly responsible for tracking fluctuating employee hours? Or maybe you have more than one EIN to manage, and compliance has become a hassle.

Many of our clients say the reason they purchased our solutions were due to ACA compliance overwhelm.

The ACA is complicated legislation, and compliance requires year-round tracking and management, yet the legislative compliance intricacies, which differ greatly from accounting management obligations, have often become another responsibility of the HR department.

ALE Determination

Are you uncertain if your company is an ALE? Our ACA specialists can help you with your questions about ACA compliance or the ACA in general.

According to the IRS ACA ALE Information Center, “Two provisions of the Affordable Care Act apply only to applicable large employers (ALEs): the employer shared responsibility provision and the employer information reporting provision for offers of minimum essential coverage.

In addition, self-insured ALEs – that is, employers who sponsor self-insured group health plans – have additional provider information reporting requirements.

Employers must determine their ALE status each calendar year based on the average size of your workforce during the prior year.

Employers that had at least 50 full-time employees, including full-time equivalent employees, on average last year, are most likely an ALE for the current year.”

We can help with questions about ACA compliance for ALEs and provide you with more information about our ACA solutions.

If you are stressed or paying too much for your ACA Software or Services, please give us a call at 800-969-7900. Or, contact us – we are here to help.