Insights on the Tax Impacts of COVID-19

Tax Implications of COVID-19

Hello again,

This post was written by Jim T., Passport Software’s Director of Training. We hope you find it useful.

The Covid-19 pandemic has obviously brought countless changes to our world. There have been massive layoffs, and for those of us fortunate enough to still have our jobs and businesses, our daily operations have changed significantly.

One of the primary changes is that many people are working from home on a daily or frequent basis. With regards to this, some tax questions have arisen. Let’s review what we know as of December 2020.

1 – Is my stimulus payment taxable?

No, even if you received a payment in excess of your actual credit for 2020, you will not have to pay back the difference.

The stimulus payments are technically an advance on a tax credit for tax year 2020. Here’s the explanation from the IRS’ website:

“Because the Economic Impact Payment you received in 2020 was an advance of the recovery rebate, the worksheet provides you a Recovery Rebate Credit to the extent your recovery rebate amount is more than your Economic Impact Payment.”

It sounds confusing, but let’s break it down:

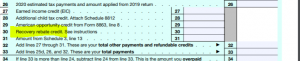

The credit that was given to eligible taxpayers is called the “Recovery Rebate Credit.” The payment that was received by most taxpayers, was called the “Economic Impact Payment”, and was an advance on the credit. If you are eligible for the credit, but did not receive one already, you can claim the credit on line 30 of your 2020 1040.

The worksheet shown below is used to produce the figure for Line 30.

Personally, I received $3,400 in 2020, including $500 for my now 18 year-old daughter. My calculated credit for 2020 is only $2,900, but I will not have to pay back the $500.

2 – Is my PPP Loan Forgiveness Taxable?

The jury is still out on this one. The Paycheck Protection Act specifically states that forgiveness of the loan is excluded from business income.

Ok, that’s great, BUT on April 30, 2020 the IRS issued Notice 2020-32 which states that “no deduction is allowed under the Internal Revenue Code for an expense that is otherwise deductible if the payment of the expense results in forgiveness of a PPP loan because the income associated with the forgiveness is excluded from gross income for purposes of the Code under CARES Act Section 1106(i).”

Translated into English, they are saying that you can’t deduct the expenses that were used to generate the PPP Loan forgiveness.

At this time, there is a reasonable expectation that this ruling will be corrected, and all associated expenses will be deductible, but stay tuned for updates.

UPDATE – great news! The new bill has clarified that “…no deduction shall be denied, no tax attribute shall be reduced, and no basis increase shall be denied, by reason of the exclusion from gross income provided.”

3 – I’m Working at Home; Can I Take a Home Office Deduction?

Historically, the rule has been that the deduction is available to employees when their primary office is in their home.

The deduction was taken as a Schedule A miscellaneous expense, subject to the 2% AGI limitation. It would have been very interesting to see how this would have played out, with so many people working from home, BUT all miscellaneous deductions were eliminated in the Tax Cuts and Jobs Act of 2017.

If you are an employee working from home, you’re out of luck, but if you are self-employed, the deduction is still available to you. See IRS Publication 587 for details on this deduction. https://www.irs.gov/pub/irs-pdf/p587.pdf

4 – What’s in the New Covid Relief Bill?

On December 27th, President Trump signed the new $2.3 trillion spending bill, which includes some items of interest for our small businesses and employees.

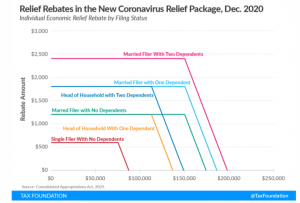

The bill includes new $600 payments to individuals making less than $75,000 per year, and $1,200 to married couples making less than $150,000.

Reduced amounts are available to singles making between 75K and $87K and couples making between $150K and $174K. There are also payments for dependents included in the bill.

Below is a summary:

5 – Will there be another round of Paycheck Protection Program loans?

Yes, the new bill provides for another round of funding. The rules for this second round of funding are a little different than the rules for the first round, and also vary depending on whether you took a loan in the first round.

The rules are still awaiting final clarification, but the early indications are that they will include these provisions, which vary depending on whether or not you participated in the first round.

If this is your “First Draw” (You did not take out a PPP loan in the first round) Your maximum loan is the lesser of:

· 2.5 times the average monthly payroll costs and healthcare costs

or

· $10 million

· You must employ fewer than 500 employees

If this is a second draw, there are more limitations. The maximum loan is the lesser of:

· 2.5 times the average monthly payroll costs and healthcare costs in the year prior to when the loan was received or within the calendar year

· 3.5 times the average monthly payroll costs and healthcare costs in the year prior to when the loan was received or within the calendar year for any business that is classified under Code 72 by the North American Industry Classification System (NAICS). (This is a list of hospitality and entertainment businesses like restaurants, hotels, and casinos; click the link to get the full list.)

· $2 million

· You must demonstrate at least a 25% reduction in gross receipts (to be defined by SBA) in any quarter of 2020 relative to the same quarter in 2019.

· You must employ fewer than 300 employees.

· You must have used, or will use, your first PPP loan.

· You do not need to have applied for forgiveness yet. Ok, this is true, but you really should get that application in.

The new applications aren’t out yet, but now is the time to reach out to your banker to make sure you get the application in time. They are due by March 31st, or when funds run out, which is the important date!

If you have any questions, call 800-969-7900. Or contact us – we are here to help.