Calculating OT with Semi-Monthly Payroll

Hello again,

We would like to thank Clayson S. at TimeClick® for this guest blog post. We hope you find this post useful for calculating weekly overtime with a semi-monthly pay period.

The type of pay period you use and the way you calculate overtime will have a significant effect on what type of calculations need to be made for your payroll. One of the most common types of pay periods is semi-monthly.

While there are advantages to semi-monthly pay periods, because they don’t line up with whole weeks it can be difficult to perform weekly overtime calculations. This guide was created to help you understand how to perform these calculations.

Calculating Employee Hours

First, let’s define a few terms.

Semi-monthly pay period – Also known as a bi-monthly pay period, this type of pay period occurs twice a month. Normally this pay period goes from the 1st through 15th and the 16th through the end of the month. However, it may begin on and end on different days. The key characteristic is that payroll is run twice a month.

Weekly overtime – Employees are paid overtime after they reach a threshold of worked hours during any given week. For most states the threshold is set at 40 hours per week, but some employers or states may offer overtime after a lower threshold.

When calculating payroll, the first step is to define the pay period type, which in our example is semi-monthly. Next, if overtime is awarded on a weekly basis, the day that the week begins must be defined. Normally, weeks begin on Sunday, but overtime may be calculated starting on any day of week so long as this is the same for each pay period.

Realize that in our example while the overtime calculations are set to start on Sunday, the pay period mostly likely will not start on Sunday. For example, running payroll for 3/16/2017 to 3/31/2017 the pay period begins on Thursday.

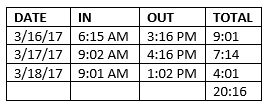

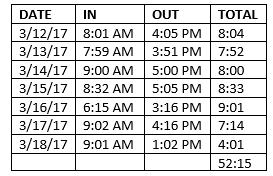

When calculating overtime for 16th, 17th and 18th of March, you have to take into account the hours from the 12th, 13th, 14th, and 15th of March even though those hours have already been paid. Here are some sample times for employee John D.

Since the pay period begins on the 16th that means that for the first week of the pay period John will be paid for the hours he worked on the 16th, 17th and 18th which is 9:01 + 7:14 + 4:01 = 20 hours and 16 minutes. The next step is to determine if any of John’s time should be counted as overtime. In order to determine if John worked any overtime this week we need to look at the hours he worked last period.

For the week of March 12th to March 18th, John worked 52 hours and 15 minutes. Since the threshold for overtime is 40 hours per week, by subtraction (52:15 – 40:00) we know that John worked 12 hours and 15 minutes of overtime this week.

The last step is to calculate how many regular work hours John had. To find this number, subtract the overtime from the total work hours from this pay period. 20:16 – 12:15 = 8:01. This means John needs to be paid 8 hours and 1 minute at his regular rate and 12 hours and 15 minutes at his overtime rate. To finish payroll, the hours from the 19th to the 31st of March still need to be calculated and added to the totals we already found.

Best ways to calculate employee time cards

There are literally hundreds of options for calculating employee time cards. While adding up paper time cards by hand is still done by many businesses it is the least efficient and most inaccurate method. There are plenty of free time card calculators that allow you to enter employee times and then it will handle the hours calculations. This prevents human arithmetic errors and speeds up the process significantly.

However, it does nothing to prevent employee mistakes and time theft that occurs when they manually fill out time cards. The best way to calculate employee hours is to use an employee time card program that will automatically calculate the hours for you and gives to the minute accuracy on employee times.

We hope you found this post helpful – Learn more about TimeClick.