In-house Payroll for Your Company

Hello again,

This post is for small to mid-sized companies who may be vetting an in-house payroll system.

The following is sourced from Nevadasmallbusiness.com. We hope you find it useful.

Employer Responsibilities

“Most people don’t go into business to manage employee payroll, but doing it right is essential to your business. Just ask your employees how important it is for them to get paid on time.

· Calculating the earnings of employees

· Determining withholding for taxes and other payroll deductions like Social Security and Medicare (FICA)

· Recording all payroll activities

· Updating records as new regulations, tax rates, personal circumstances of employees and other payroll data change

· Preparing and filing accurate and on-time tax documents and returns with federal, state and local tax agencies

· And last, but most importantly, handing out paychecks.

· You can outsource your entire payroll process or do it yourself. For start-ups and small businesses, keeping payroll in-house offers both tangible and intangible benefits.

The Upside

The upside of in-house payroll management gives you total control over the accuracy of the information and the cost of payroll. Doing it yourself, or having a skilled administrator do it for you, is a low-cost proposition.

Here are a few reasons to keep payroll functions in-house:

· Catching payroll errors quickly. When you outsource payroll, you may not discover errors until employees receive their paychecks. Looking things over regularly lets you catch mistakes in advance, so you avoid unhappy employees and tax collectors.

· Data security. In an age of data breaches, the best way to have control over the security of all personal financial data is to keep it within your four walls.

· Integration with other business systems. Company data and metrics are more easily merged and analyzed when everything is accessible. It’s simpler to determine the cost of acquisition of a new client, or to merge your payroll and financial systems, when everything is on hand.

Making the Decision

To help you decide, ask your accountant to help you analyze what it is costing you to handle payroll management in-house vs. what outside companies are charging.

Be sure to include the time you or your employees spend:

· Gathering payroll-related information

· Calculating wages based on time cards, performance bonuses, annual raises and other variables

· Determining local, state and federal taxes quarterly and annually

· Depositing taxes with the appropriate authorities

· Staying on top of changes in tax regulations

· Buying and learning how to use a payroll software package, and the training required to use it properly.

Should you handle in-house payroll? That’s a decision to make after consulting with your accountant. Track the hours, crunch the numbers and decide for yourself if keeping payroll in-house is right for you.”

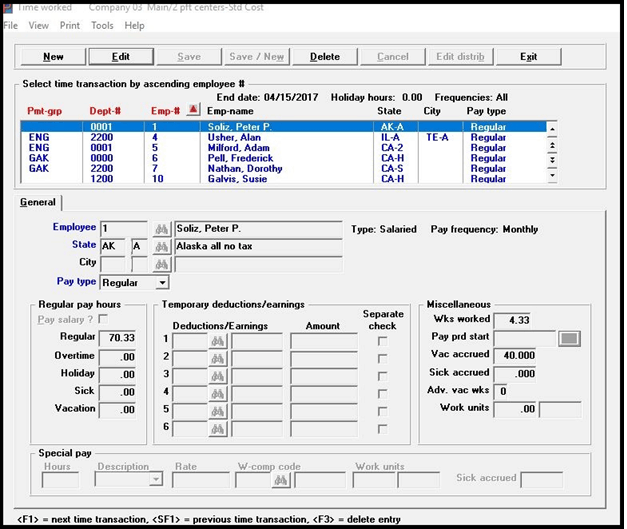

With 35 years of payroll processing experience, Passport Software provides comprehensive yet easy to use in-house payroll software for small businesses and medium sized companies.

The payroll module is part of Passport Software’s accounting software solution.

Call 800-969-7900 – Or Contact Us. We are here to help.