ACA Reporting Updates for the 2020 Tax Year

ACA Reporting for Your Company

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

The Affordable Care Act remains the law of the land for 2020 in spite of the 2018 Texas ruling regarding the constitutionality of the law.

This year’s pandemic has resulted in mass layoffs, and the recovery will result in new hires and rehires for many companies. Or perhaps employee status from full to part time has fluctuated during this period.

As the economy improves, employers will tend to rehire laid off workers that were in good standing versus new hires. Some of these workers may be rehired for temporary or consulting work before being on-boarded full time as the economy continues to recover.

It is important to keep tabs on health care coverage offerings and on fluctuating employee status, and if you are manually tracking, ACA Software or an ACA Reporting Service may help simplify data management.

Employer Mandate

Employers with 50+ full time employees (or full time equivalents) are still required to remain compliant and meet the 2021 deadlines for reporting.

· 1095-Cs issued by January 29, 2021

· 1094-C and copies of 1095-Cs to be filed: Paper filing by February 26, 2021 or Electronic filing (250+ 1095-Cs) by March 31, 2021

· Good Faith transition relief for 2018 reporting: Employers filing forms on time but with missing or inaccurate information will not be assessed penalties (if they worked in good faith to complete the forms)

If you receive a letter 226J penalty notification, contact an ACA compliance expert. This effort may help you avoid or drastically reduce penalties.

Passport Software

The employer responsibilities legislated by the Affordable Care Act are complex and have many contingencies. The filing process is exacting and unforgiving.

For a smaller ALE (applicable large employer) whose 50 or slightly more employees are all full-time, salaried, covered by a grand-fathered insurance plan, and who generally has no personnel changes through the year, a simple spreadsheet might work to track ACA data.

But as soon as things get any more complicated, the work of updating and reviewing compliance data can take much more time and mind-share to manage.

If you are manually tracking or your current solution is not comprehensive or affordable, we can help.

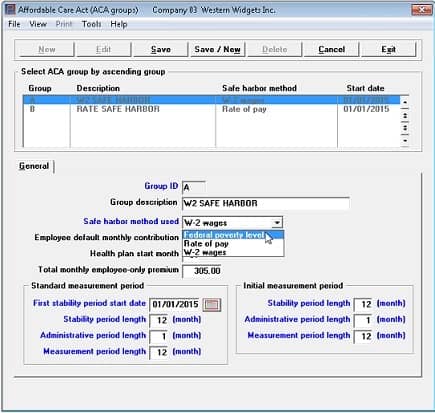

Our ACA Reporting Services include ACA Full-Service (we do it all for you throughout the year) and we are IRS-approved to file on behalf of our ACA Reporting Software customers. Our software is easy to use and provides easy data-import, helps you track compliance throughout the year, and is IRS-Certified.

We also provide penalty relief consultation services, and have helped many companies reduce or avoid penalties.

We can help you simplify compliance during this chaotic and difficult transition period as company employee status fluctuates and shifts throughout the 2020 tax year.

Call 800-969-7900 to learn more. Or contact us – we are here to help.