Check Reconciliation – Tips

Check Reconciliation – Combat “Blur”

Hello again,

This post is for accountants and bookkeepers. Here are some tips for Check Reconciliation, and in particular how to combat “blur.”

It is sourced from CPA Practice Advisor by David H. Ringstrom, CPA, and Gail Perry, CPA, Editor-in-Chief (excerpted from Idiot’s Guides: Introductory Accounting.) We hope you find it useful:

Reconciliation

“Reconciliation ensures that your books agree with what the bank shows as your current balance. Here’s how to reconcile your accounts, in a nutshell:

· You’ll mark transactions that match both on your bank statement and in your books as cleared.

· Transactions don’t yet appear on your bank statement are still in transit, and so you’ll leave those on your books as uncleared.

· If you find transactions that appear in both places but with amounts that don’t match, you’ll make corrections in your accounting software to bring your books up-to-date. However, banks are not infallible, so if you find an error in your bank statement, it might be best to temporarily change your books to reflect the erroneous amount while you investigate the issue with your banker.

Tips for Successful Reconciliations

One of the biggest challenges of reconciling a bank account, particularly one with lots of transactions, is combating the “blur.” As you compare the many numbers and columns on your statement to the reconciliation window, it won’t take much for your eyes to glaze over.

To help with this, most modern accounting programs allow you to sort columns within reconciliation windows. Simply click a column heading, such as Amount, to sort the transactions in ascending amount order (smallest to largest). Click the column heading a second time to sort in descending order (largest to smallest). Every column within the reconciliation window should be clickable and, therefore, sortable. Click the Date column to return items to Date order.

If your reconciliation takes several screens to view, you might be able to zero in on an out-of-balance amount by sorting on the dollar amount column. You often can sort by payee or check/reference number as well.

All of the scrolling and clicking involved with reconciling a bank account can quickly become tedious. You’ll likely be relegated to using your mouse with cloud-based programs such as QuickBooks Online, but there’s an easier way in desktop-based accounting software. Within the reconciliation window, you can use the up or down arrow keys on your keyboard to navigate the list and then tap the spacebar on your keyboard to toggle between marking an item cleared or uncleared.

Finally, as much as you might hope to, you won’t always be able to finish your reconciliation in a single sitting. Anticipating this, your accounting software lets you save your work in progress. Depending on the software, you might see a Leave or Finish Later button. If you don’t see a button like this, simply close the reconciliation window and a prompt should appear asking if you want to save your work.

Automated Reconciliations

Depending on the accounting software you use, you might be able to have your software automatically reconcile your bank account for you. Once you grant permission for your software to connect to your bank account over the internet, at your request, it can synchronize transactions from your bank account with your accounting records, automatically clearing any matches.

Anything that doesn’t match is left on-screen for you to decide how to handle.

Unmatched transactions could be items that cleared your bank account before you entered them into your accounting software. Or, maybe you inadvertently entered the same transactions more than once in your accounting software. If this happens, you can simply delete or void the duplicate transaction.”

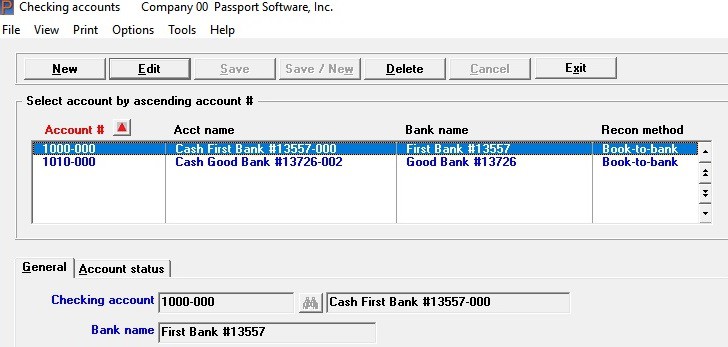

Passport Software’s Check Reconciliation Software provides safeguards against getting your information out of balance or getting tangled up during the reconciliation process.

Call 800-969-7900 to learn more. Or Contact Us – We are here to help.