PBS Accounting Software for Small Business and Mid-Sized Companies – Entering the Tax Tables

PBS™ Accounting: Entering the New Year’s Tax Tables

Hello again,

The following was written by by Peter Dalziel, and we hope you find it useful.

Note: Passport has published this document as a practical guide and help to the updating the PBS tax tables. Although there may be possible interpretations implied by some of the statements in this document, we make no claim to be qualified to interpret tax law. That should be a matter for your accountant.

Entering the new year’s tax tables can be stressful and with the rush to get everything right, this last week of December and first week of January tends to be anxiety laden.

In many cases the problem comes down to words and specifically the issue of taking a verbal equation like “If the Adjusted Annual Wage amount is at least ‘mmmm’ but less than ‘nnnn’, the tentative amount to withhold is ‘xxxx’ plus this percentage yyyy of the amount that the adjusted annual wage exceeds zzzz’.”

The second thing that is confusing is that the first line of each table deals with the case where no withholding is required. Since PBS “knows” from the rest of the table that no tax is due this line is not needed in the PBS™ Accounting Software table.

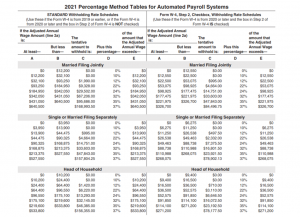

The table the people will want to use is from the P15t.pdf document available here.

The table is actually two separate tables (on left and right side) each with 3 sub-tables.

Please note, we understand that some number of our clients have most or all of their employees working-based information from the pre-2020 W4’s. However, as we see it, any new employees should fill in the new 2020/2021 W4 and follow the appropriate procedure in PBS for entering the (different) kinds of information taken from that form. The tables on page six of the IRS P15t document, described below are the ones designed for the PBS implementation of the information from these “new” 2020/2021 W4 forms and these tables include the new allowance category “Head of Household”.

Confusingly, there is also a table on page 60 of this document that has the same numbers for the Federal Standard table for just Single and Married. This table can only be used if you have no employees working under the new 2020/2021 W4 and if you do not intend to use that new form in the coming year. In other words, if you will be continuing to have all employees working with the old “exemption”-based pre-2020 form. (Basic exemption this year is unchanged at $4,300) Below is that page-six pair of tables:

The left-hand table is referred to as the Federal ‘Standard’ table and is used for people who are still working under the pre-2020 W4 form or, who are working under the new 2020 form but who have not checked box 2c on that form (i.e., for people who are NOT employed at two or more jobs with different employers). The right-hand table is for people who ARE working at 2 or more jobs with different employers.

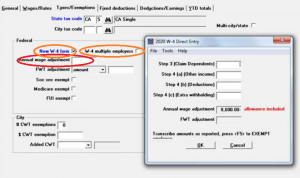

A switch in the Employee file record for each employee is set to indicate which of the two W4 documents is the basis. Further, if it is under the newer W4, the Multi-employer option has to be selected (Box 2/c of the 2020 or later W4 form).

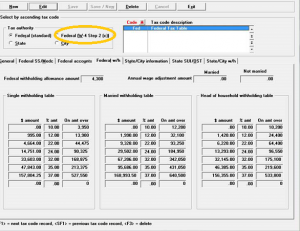

In PBS this right-hand table is referred to as either the Federal M tables (Multi-employer) or the Federal W4 step 2/c table.

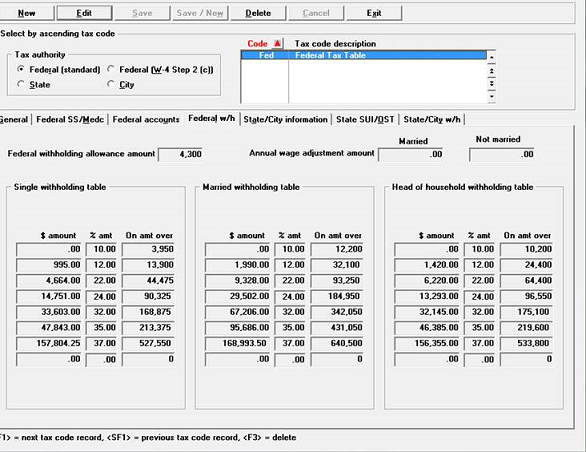

The corresponding PBS™ Accounting Software tax table for the Federal Standard looks like:

The corresponding Federal “M” table (Federal W4 Step 2/c table) is accessed by clicking on the radio button circled in orange above.

Note that the PBS sub-tables are in the order Single, Married, Head of Household (HoH) whereas, the Federal tables are in the order (vertically Married, Single, Head of Household (not shown)). Also note that the Federal document labels the columns A through E. In PBS the columns are labelled ‘$ amount’, ‘% amt’, ‘On amt over’. These correspond directly to columns C, D and E of the Federal Tables.

So, the rules/steps for updating the tables are:

1. Ignore the first line of each sub-table. PBS takes care of this automatically for the zero-dollar tax situation.

2. Copy the data from the Federal table into PBS. This can be done by reading and typing or copying and pasting from the PDF listing into the PBS screen. In graphical style screens as used in this document, the data can be entered/copied into PBS in any order. If you are copying and pasting, doing this by column may be faster and easier. Copy the PDF columns C to $ amount, D to % amt, E to “On amt over”.

3. Generally, you will find the percentages for Single, Married, and HoH are the same for all three sub-tables. As a result, it may be easier to copy these from one PBS sub-table to the next.

4. Using this technique, each sub-table should take maybe 4-5 minutes and the whole set of 6 sub-tables (3 for Federal standard and 3 for Federal “M”) should take 30 minutes or less.

5. Since the tax tables are unique to each company, the tax tables must be updated individually in each company if you are using PBS with multiple companies. This is clearly an extra burden and we are looking to doing something to lighten this load.

A final note to implement the “new” 2020/2021 W4 we created a special data entry screen that closely corresponded with the new W4 calculation sheet. Having a) checked off the ‘New W-4 form’ and check off (or not) the ‘W4 multiple employers’ box, you have an option while entering the Annual Wage adjustment, to hit sF2 – see orange high-lighted items below. This will cause the “W4 direct entry screen” to be displayed. The number entered here come directly of the 2020/2021 W4 with the addition that there is a default part of the Annual Wage adjustment that is determined by your marital status.

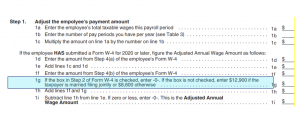

On page 5 of the P15t document, step1g has the following:

PBS automatically defaults these amounts based on the marital status of the employee in conjunction with the values entered into the two “annual wage adjustment amounts” given on the 4th tab of the Federal standard table (“Federal w/h”):

As you can see in the above ‘detailed entry screen’ the program has chosen 8,600 as the beginning Annual wage adjustment prior to any other data having been entered. This is because this employee is single.

You will note that, if you look at the equivalent 4th tab of the Federal “M” record, all the fields in this line are greyed out because the data for the multiple employers situation comes from a separate calculation sheet described in the 2020/2021 W4 form (https://www.irs.gov/pub/irs-pdf/fw4.pdf ) and for interpreting that, consulting an accountant.is probably advisable.

Bottom line, for the most common case of having a single employer, these two fields with these two values provide the default values which with other information from the ‘detailed entry’ screen data, taken from the W4 (steps 2 through 4), will compute the Annual wage adjustment as well as the (per period) FWT adjustment – highlighted in red above.

We hope you found this information useful. Learn more about our accounting software for small business. Or contact us – we are here to help.