Desktop Accounting Software Advantages

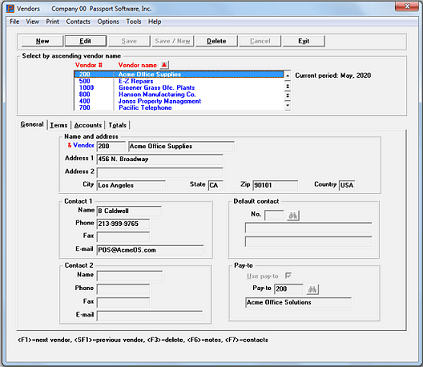

Software as a service (SaaS) cloud solutions seem popular, but we have recently seen a surge in requests for Passport Business Solutions™ (PBS™), our on-premise accounting software.

Several reasons companies are returning to on-premise accounting software are reining in costs, controlling security measures, and securing critical data ownership privacy. SaaS systems tend to be out-of-the box solutions scaled for larger companies. For a small to mid-sized company, these may prove too expensive, cumbersome, and not tailored to your unique needs.

- Look at annual cost of ownership when investing in any application. The potentially lower upfront payment for SaaS can be deceptive as ongoing monthly/yearly payments add up quickly, and it can become very expensive.

- PBS™ is an on-premise accounting software with a one-time licensing fee offering substantial cost-savings over SaaS.

- With PBS™ desktop accounting, there are no ongoing monthly payments to retain access to your data.

A recent review of a popular subscription accounting software states, “It seems that without keeping or purchasing a new subscription…we can no longer access any of our historical data. That data that may go back dozens of years…It feels like we are being held hostage for our data that we have paid dearly for over the years.”

Critical Data Ownership

With Passport Business Solutions™ desktop accounting software, you own your data and have control over the software and your server. Even when the internet is down, you can process your financial data.

- You control and change security measures, including physical access to your computers and server at any time

- Set permissions and user restrictions to control access

- PBS™ has excellent audit trails that support fraud prevention measures

Did you know that there are very few on-premise accounting software solutions with a perpetual license?

PBS™ is robust, professional-level software with a one-time licensing fee and a nominal fee for annual updates. With PBS™ desktop accounting software, you own your data, control security measures, and our expert consultants can tailor a solution to meet your unique needs. Our in-house payroll program can provide ongoing ROI due to cost savings versus an outside payroll service.

PBS™ Payroll Streamlines Payroll Processing

Many companies are spending far too much time, effort, and money than they need to on an outside payroll service. PBS™ Payroll is a comprehensive, easy-to-use, and secure in-house payroll processing for small to mid-sized companies to streamline payroll processes.

Our in-house payroll provides cost savings vs. an outside payroll service and can provide you with ongoing ROI.

- PBS™ Payroll is cost-effective, streamlines payroll processing, and helps companies maintain compliance with federal, state and local taxation. Flexible, automated features accommodate a variety of payroll needs.

- PBS™ Payroll can be run independently or interfaced with PBS™ desktop Accounting software (including optional Affordable Care Act compliance), Distribution, or Manufacturing ERP suites. PBS™ is a modular solution so you can select only the modules you need and add-on as you grow.

- If you have comprehensive payroll requirements, you can benefit from Passport’s solid, proven Payroll with optional Affordable Care Act compliance solutions.

With 40+ years of helping small to mid-sized companies, it is likely we have helped businesses with challenges similar to yours. Our goal is to help you configure a desktop accounting system that provides an excellent fit for your company. We pride ourselves on getting to know your business processes well enough to support your company’s unique needs.

The modular design of our on-premise accounting software and many configurable options will allow you to tailor a system to meet your individual needs. Invest only in the technology you need today and add to your system as your needs change.

Contact us to learn more about PBS Accounting, our on-premise software for small businesses and mid-sized companies.