ACA Software Streamlines Data Management to Help Reduce Penalty Risk

Comprehensive ACA Software Helps Maintain Compliance Year-Round

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

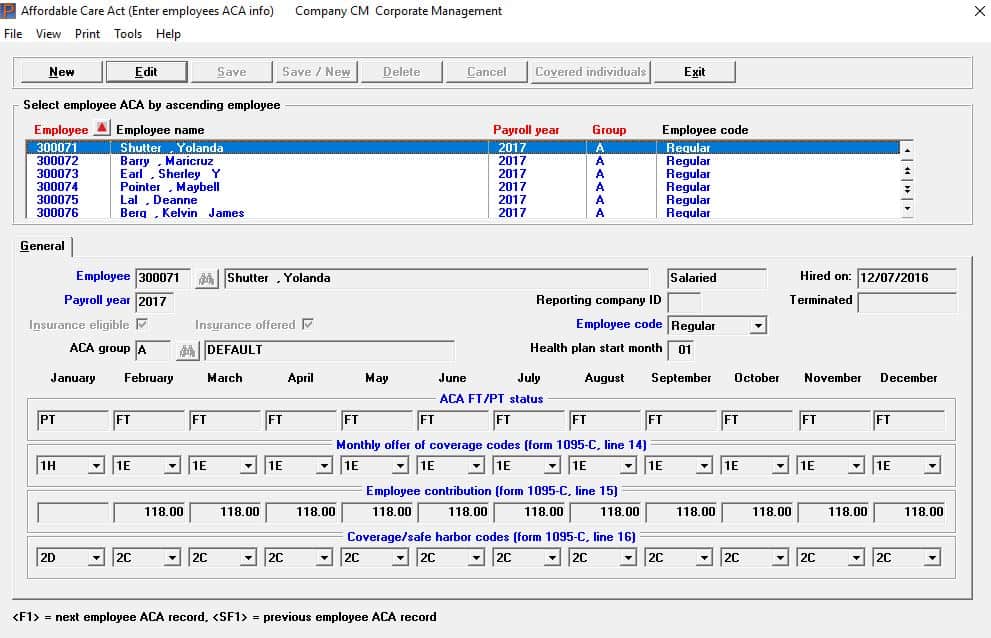

If you are a busy HR professional or administrator tasked with Affordable Care Act compliance management, our IRS-certified ACA software can help you simplify the entire process. Passport Software’s ACA software solution streamlines data management, helps reduce errors that can happen if you’re manually tracking, and can help reduce penalty risk.

The IRS is issuing penalties for the 2019 tax year and, as there is no statute of limitations, could issue penalties for previous years. In spite of the IRS backlog, continued enforcement is inevitable.

Penalties can be steep, and our ACA software and services can help ease the burden of compliance

Letter 226J

Letter 226J is a penalty notification issued to companies the IRS believes are non-compliant with the ACA Employer Mandate for a specific tax year. The Employer Mandate requires Applicable Large Employers to provide appropriate health coverage to qualifying staff and their dependents. Late or inaccurate filing can also result in penalties.

The recent eligibility expansion of the Premium Tax Credit increases health coverage affordability for certain income brackets. The PTC expansion could result in more employees declining coverage offered by an employer and purchasing it through a health exchange.

According to irs.gov, “The premium tax credit – also known as PTC – is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace.”

The IRS can cross-reference data on an employee’s PTC application and 1095-C to identify and determine if an employer offered appropriate coverage. If the IRS claims the employer did not offer appropriate coverage, the burden of proof is on the employer.

Letter 5699

Letter 5699 is an IRS warning notification for companies that are, or appear to be, non-compliant with the Employer Mandate for a tax year. It can but does not always precede Letter 226J. This letter affords ALEs the opportunity to correct any mistakes on any inaccurately filed 1094-Cs or 1095-Cs for the tax year in question.

Data accuracy is important when filing in order to avoid potential penalties, and our comprehensive ACA software can help streamline compliance management to help reduce errors.

If you are tasked with ACA compliance management, it’s important to track employee data year-round in order to make appropriate offers of coverage. As a busy company owner, HR professional, or administrator, compliance management duties can be varied and complex. Our ACA software can help simplify compliance management, and our experts can walk you through the entire process and can answer any ACA-related questions.

Letter 5005-A and Letter 972CG

Letter 5005-A is issued to employers that failed to file Forms 1094-C and 1095-C with the IRS or failed to furnish 1095-Cs to employees for the applicable reporting year. It’s important to file and furnish forms within the applicable IRS deadlines. It’s important to stay updated about deadlines or deadline extensions for the applicable tax year.

Several states now have ACA reporting requirements in addition to federal ACA compliance regulations. Failing to comply with state ACA regulations and state filing/furnishing deadlines can also result in state-issued penalties.

Letter 972CG is a penalty notification for ALEs for late-filing, while Letter 5005-A is a penalty notification for failure to file altogether. If the IRS received incorrect filing information, providing the corrected data could reduce a penalty.

If you have received an ACA penalty notification or warning letter, it’s important to respond in a timely manner. We offer penalty response consultation services and have helped many companies avoid or drastically reduce penalties.

Passport Software

Our IRS-approved ACA software can help you manage ACA compliance year-round. Our ACA software solution can serve as a standalone solution or optionally integrate with our Passport Business Solutions™ Accounting suite.

Smaller businesses outgrow their accounting solutions faster than bigger companies, and you may have outgrown your entry level solution. If you are tired of using workarounds such as spreadsheets, underwhelmed with support or need a more robust accounting solution, we can help.

Sometimes what doesn’t grow as fast as it should is the budget for a professional-level, mid-range accounting solution. We can help. Passport Business Solutions™ (PBS™) Accounting is a scalable modular solution that can grow with your business, and PBS provides in-depth reporting for better decision making for your company.

We also provide comprehensive yet easy to use in-house payroll software for small businesses and medium-sized companies. Our on-premise accounting payroll program can provide ongoing ROI due to cost savings versus an outside payroll service.

Passport Software’s optional payroll software is part of the PBS™ Accounting suite and includes an optional ACA software module to streamline ACA-related data. If you are underwhelmed with your current ACA solution or doing most of the work on behalf of your payroll provider, we can help.

Our ACA software also provides reports that indicate when offers of coverage are needed and if those offers are considered affordable under IRS criteria. We are also IRS-certified to provide optional proxy submission on behalf of our software customers. Our ACA Full Service, is the easiest option – just provide a spreadsheet and we do the rest including filing.

Learn more about how our IRS-approved ACA software can help you monitor compliance throughout the year in order to help prevent penalties. Or, contact us – we are here to help.