Affordable ACA Software and Services with Excellent Support

Vetting Your ACA Provider

Hello again,

Applicable Large Employers have been complying with the ACA since reporting to the IRS began during the 2015 tax year. However, many companies still make ACA compliance and reporting mistakes. ACA reporting errors can trigger IRS audits and lead to costly penalties.

It’s important to use correct code combinations and verify there is no missing or incorrect information on the 1094-C transmittal. Full-time calculations must be accurate in order to provide appropriate offers of coverage.

Selecting Your ACA Solution

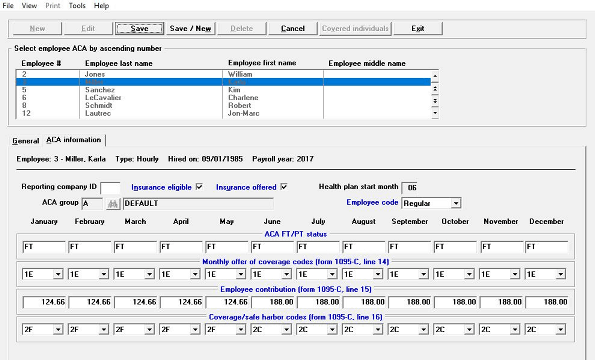

Your ACA software or ACA Full Service provider should make compliance easy, as well as affordable, with excellent support. Our IRS-certified ACA software provides year-round data management and tracking, not just forms-only reporting. The ACA Full Service option is even easier – just provide a spreadsheet with employee data, and we do the rest, including filing.

Passport Software provides the expertise to answer any ACA-related questions, and we can help with coding, employee classification, and selection of the correct Measurement Method. Our ACA software and services will help you simplify and comply and allow you to have the proper electronic documentation in case of an IRS audit.

Expert Consulting

We provide various options of services to meet your needs, including ACA Full Service, optional proxy submission for our ACA software customers, and penalty response consultation services. We’ve helped many companies avoid or drastically reduce penalties.

Expert consulting can help your ACA administrator stay up to date on changes to the ACA and provide guidance if your staff is not fully trained. Staying on top of updates to the ACA is important, as well as keeping up with state reporting requirements, which can change annually. If your company operates in several states, your filing obligations can become complex.

ACA Forms Filing

The IRS has released the finalized versions of ACA forms for the 2023 tax year:

– 1094-C, filed by ALEs, reports summary information about coverage offered to employees and is used to transmit Forms 1095-C to the IRS.

– ALEs must file a Form 1095-C for each full-time employee (during any month of the calendar year) and send a copy of Form 1095-C to these employees.

– 1094-B is the transmittal form that must be filed with Form 1095-B to the IRS.

– 1095-B is used by self-insured ALEs (the company pays for the medical bills of its employees) to report employee minimal essential coverage information.

The threshold for electronic filing has been lowered to 10+ returns in a calendar year. This means an ALE that files 10+ returns or forms in a calendar year is required to e-file in 2024. The 10-return threshold includes: Forms 1042-S, 1094 series, 1095-B, 1095-C, 1097-BTC, 1098, 1098-C, 1098-E, 1098-Q, 1098-T, 1099 series, 3921, 3922, 5498, 8027, W-2, and W-2G.

Passport Software can help you streamline reporting and data management year-round to avoid costly penalties. Our helpful experts can walk you through the entire process to help you simplify and comply.

To learn more about how our ACA software and services can ease the burden of compliance, call 800-969-7900. Or, contact us – we are here to help.