ACA Software and Services Make Compliance Easy

What is the worst part of ACA compliance management?

Hello again,

This post is for Applicable Large Employers (ALEs) required to comply with the Affordable Care Act. We hope you find it useful.

What is the most challenging part of ACA data management and filing? Some of our customers came to us for help with tracking employee data, others tell us the codes are confusing.

Others wanted us to file on their behalf, and some folks say the worst part of ACA compliance is, “The government makes me do this.”

Whatever your trouble spots are regarding ACA compliance management, we can help.

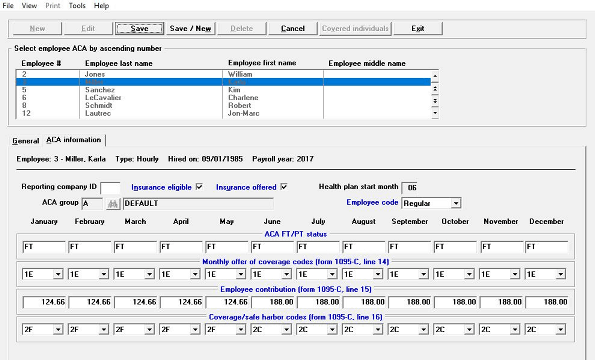

Our affordable ACA software works with whatever payroll you’re using, whether in-house or outsourced.

A simple spreadsheet template makes importing employee info into our comprehensive ACA software easy. Customers who were manually tracking employee data have commented that they wish they had known how easy it could be, using our software or full service.

Since 2015

Passport Software has been helping customers with tracking and filing since ACA’s inception. We provide easy-to-use ACA software and services:

– Providing software to track and file

– Full Service – turn the whole thing over to us to do it all

– Consultation – Forgot to file? Filed and received fines? Maybe missed a year or two? We can help with all of that.

Are you underwhelmed with your current ACA software or services provider?

– Too expensive?

– Unresponsive?

– You do all the work and still pay too much?

– Won’t file on your behalf?

Passport Software

We can help ease the burden of ACA compliance and reporting. Our knowledgeable experts can clarify which codes are appropriate for filing and help you to understand new codes when they are added to the forms.

If you are struggling to track employees with fluctuating hours or multiple job duties/pay rates, we can help you effectively manage employee data and offers of coverage year-round.

We provide much more than forms-only software used to file ACA-related data. Our ACA Software or ACA Full Service option helps you manage data throughout the year to help avoid penalties.

According to the ACA Times, “the IRS has begun issuing Letter 5699 to employers for the 2019 tax year.

Officially called “Missing Information Return Form 1094/1095-C,” Letter 5699 is the precursor notice that is issued to employers before a penalty assessment.

The IRS issues Letter 5699 to Applicable Large Employers (ALEs) identified as having failed to file applicable ACA Forms 1094-C and 1095-C for a specific tax year as required under the ACA’s Employer Mandate.”

If you have missing forms information or have failed to file in past tax years, we can help.

We also provide penalty consultation services and have helped many companies avoid, or drastically reduce penalties.

Our experts are friendly and knowledgeable, and we provide excellent US-based customer support. Call 800-969-7900 to learn more about our ACA Software and Services. Or, contact us – we are here to help.