IRS Taxpayer Identification Number (TIN) Matching Service (Steps for Sign-up and Usage)

IRS TIN Matching Service

Hello again,

This post is about the IRS Taxpayer Identification Number (TIN) Matching Service – we hope you find it useful.

This documentation is intended to help you become an authorized user of the IRS TIN Matching Service and learn to use it for your greatest benefit.

Steps to sign up

1. There is no fee for application or usage of this IRS service.

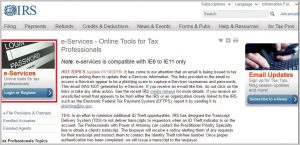

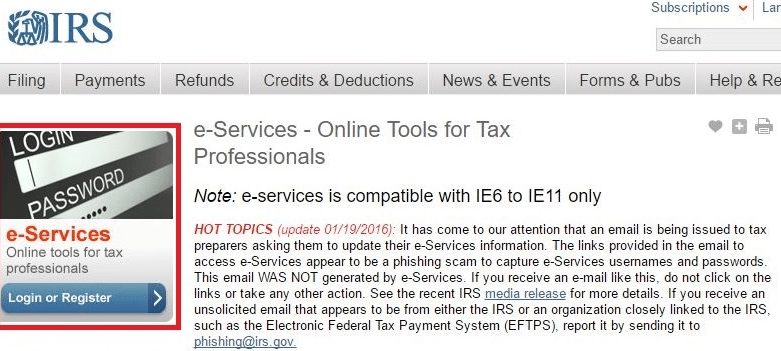

2. Register on the IRS E-Services site. If you have a Transmitter Control Code (TCC) then you are already registered and can simply log in.

3. Apply for the TIN Matching service.

4. When you log in after your application has been approved, you will be able to select the specific TIN Matching organization. This is different than the ACA filing.

5. Go to the E-Services TIN matching page.

6. Accept terms and conditions.

7. Select Interactive TIN Session or Bulk TIN Session

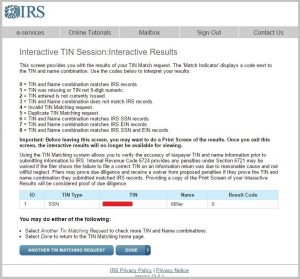

8. Interactive TIN Session

a. Required fields

i. TIN Type droplist—Unknown/SSN/EIN

ii. SSN/EIN

iii. Last Name/Business Name

b. Add/Clear

i. Added requests will display in a list (maximum of 25 per batch), which may be edited or deleted. Limit of 999 Interactive requests during a 24-hour period.

c. Cancel/Submit

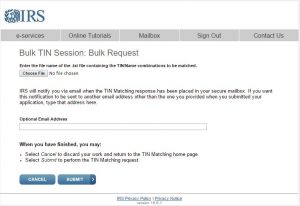

9. Bulk TIN Session

a. Fields/Options

i. Choose File (required, in .txt format)

ii. Email address (Optional, if different from the email on file)

iii. Cancel/Submit

b. Up to 100,000 name/TIN combinations per file (no limit on the number of separate files)

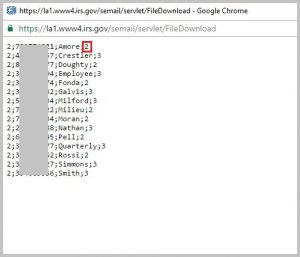

c. The .txt file will be formatted as follows:

i. TIN Type (1 = EIN, 2 = SSN, 3 = Unknown)

ii. TIN (9 digits only, hyphens/spaces/other characters are not permitted)

iii. Name (up to 40 characters. The system will only accept limited special characters in the name line for Bulk TIN Matching. Hyphens and ampersands will be accepted. Commas, apostrophes and other special characters should be omitted from the name line. For instance, the name O’Malley & Sons should be input as OMalley & Sons.)

iv. Account Number (optional field for your use – up to 20 Alpha/numeric – NOTE: the system will not read this information)

v. A semi-colon (;) will be the delimiter between fields (no spaces anywhere except between first/last names)

vi. Each line of input will signify a new record. Example:

1. TIN Type; TIN; Name; Account Number

2. TIN Type; TIN; Name;

vii. When naming your .txt file, do not use special characters in the file name. Type the file name in plain fonts, (Courier works best), and place the dot extension directly before the file name extension. Example, a file named TIN Match Vol2 should be saved as TIN Match Vol2.txt. Unacceptable file names, such as TIN.Match.Vol2.txt or TIN_Match_Vol2.txt, may cause your file to be rejected by the system.

viii. If you submit a record without the required fields (TIN Type, TIN, Name), the response you will receive will be Indicator 4, Invalid Request.

ix. If you don’t know the TIN Type, enter “3” and the system will check both the SSN and EIN master files.

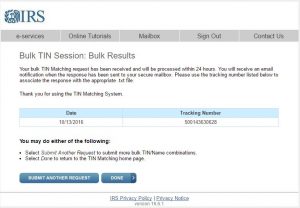

x. Within 24 hours, the response will be sent to a secure mailbox and an email notification will be sent to you indicating a response is waiting. You will have 30 days to access and download the results file. Once accessed, the results are retained for 3 days before being purged. The same information you sent in the .txt file will be returned with one additional field containing the results indicator.

d. Accept/Decline

10. Accessing results of Bulk TIN Session

a. You will receive an email notice once your bulk TIN Matching submission has been processed. To review the results, log back into your E-Services account and navigate to your Mailbox, outlined in red below

b. The Mailbox will contain responses to your uploaded TIN Matching .txt files. You can view or download your original .txt file.

c. The original upload file will display with an appended code to the right of each line. These are the same codes listed above. “0”

· ‘0’ – Name/TIN combination matches IRS records

· ‘1’ – Missing TIN or TIN not 9-digit numeric

· ‘2’ – TIN not currently issued

· ‘3’ – Name/TIN combination does NOT match IRS records

· ‘4’ – Invalid request (i.e., contains alphas, special characters)

· ‘5’ – Duplicate request

· ‘6’ – (Matched on SSN), when the TIN type is (3), unknown, and a matching TIN and name control is found only on the NAP DM1 database

· ‘7’ – (Matched on EIN), when the TIN type is (3), unknown, and a matching TIN and name control is found only on the EIN N/C database

· ‘8’ – (Matched on SSN and EIN), when the TIN type is (3), unknown, and a matching TIN and name control is found on both the NAP DM1 and the EIN N/C databases

Additional IRS documentation: https://www.irs.gov/pub/irs-pdf/p2108a.pdf

Simplify Affordable Care Act Compliance. Learn more: Passport Software’s ACA Software or Contact Us.